Fast Info About Automotive Costs

Automotive customers could lastly get some reduction because the Federal Reserve pulled the lever on the primary rate of interest drop since March 2020. Finally, the speed drop will assist dent automobile mortgage rates of interest, although not quickly sufficient for customers seeking to take out auto loans proper now. At half a share level, the Fed’s transfer will take a number of months to achieve debtors who finance a automobile. Nonetheless, incentives to entice customers to purchase autos proceed to climb. These elements might help these out there proper now.

In recent times, automobile customers have develop into accustomed to paying greater than the producer’s prompt retail worth (MSRP). They watched automobile costs rise with no obvious finish in sight. The scenario left many consumers scratching their heads, and the query our consultants hear most is, “When will new automobile costs drop?”

New car worth inflation all however disappeared by the top of final 12 months. Nonetheless, automobile costs have elevated dramatically up to now three years. Learn on for steerage if you wish to buy a car. We offer the most effective data from our consultants and dig deeper to reply considerations about automobile costs.

New Automotive Costs Fluctuating

Common transaction costs, which climbed all through the final a number of years, started dropping in 2024 however have continued to fluctuate because the starting of this 12 months. In August, Kelley Blue E book information present common transaction costs have been $47,870, barely decrease than final 12 months’s $48,126.

“In our newest seller survey, the message about worth stress was very clear,” stated Erin Keating, govt analyst at Cox Automotive, the dad or mum firm to Kelley Blue E book. “Sellers are telling us the gross sales surroundings is buzzing alongside at a muted tempo, and there may be rising stress to decrease costs.”

This volume-weighted calculation displays all of the automobile market realities, together with high-volume autos like expensive pickup vehicles influencing the quantity. For instance, the report exhibits that full-sized pickups posted a median transaction worth of about $65,500.

Moreover, electrical autos posted common transaction costs of $56,575 in August. The nation’s largest electrical car (EV) vendor, Tesla, noticed its common transaction worth stay about the identical at $59,138 in comparison with July. Nonetheless, Tesla costs are increased year-over-year by practically 11%. That’s probably because of its Cybertruck, which has costs beginning at $101,985, together with the vacation spot price of $1,995.

For customers preferring cheaper autos like compact SUVs (the market’s hottest phase by quantity), August’s common transaction worth was $36,506.

Total, common transaction costs stay greater than 10% increased than in August 2021, when the realities of the COVID-19 pandemic appeared endless. At the moment, common transaction costs for brand spanking new autos have been $43,351.

In August, producers added extra car incentives, a median of $3,447, to assist transfer 2024 fashions and make method for 2025 fashions.

What Drives New Automotive Costs

- Stock availability

- Producer incentives

- Supplier reductions

- Commerce-in car worth

New Automotive Stock Replace

August stock information is extra secure after two months of volatility following June’s cyberattack affecting Illinois-based CDK World and 15,000 dealerships. Because of this, the Cox Automotive vAuto Dwell Market View went from displaying an irregular 116-day provide of stock in the beginning of July to 68 days in the beginning of August to 77 days in the beginning of September.

Dealerships measure their inventory of latest vehicles to promote in a measurement known as “days of stock,” or how lengthy it could take them to promote out of latest autos at immediately’s gross sales tempo if the automaker stopped constructing new ones.

About 25% of the autos in a sellers’ showroom are actually 2025 fashions. The opposite 75% of autos have to be offered earlier than the top of the 12 months. Stellantis, the dad or mum firm to the Alfa Romeo, Dodge, Chrysler, Jeep, and Ram manufacturers, elevated its incentives to 7.8% of the typical transaction worth in August from 5.7% in July. Information present that sellers in a number of markets nonetheless have to promote 2023 model-year autos on their tons. Based on the vAuto information, Dodge provide of autos is greater than twice that of the nationwide common for days’ provide of stock.

Car Incentives Get a Bump

Carmakers boosted their incentives to lure consumers in August. Based on Kelley Blue E book’s analysts, carmakers spent 7.2% of the typical transaction worth, or $3,447, on incentives meant to maneuver autos. That’s the best quantity in over three years and about $64 greater than July. New EVs additionally noticed extra vital and higher incentives of over 13.3% of the typical transaction worth.

When automakers construct an oversupply of vehicles, they low cost the autos to get them off seller tons. For a number of years, carmakers and dealerships confirmed no glut of vehicles to promote and barely supplied reductions.

Stellantis elevated its incentives to 7.8% of the typical transaction worth in August from 5.7% in July. Final month, electrical automobile incentives averaged 13.3% of the typical transaction worth. Dealerships supplied increased reductions on Buick, Lincoln, and Mitsubishi autos. Nissan and Infiniti additionally supplied first rate incentives in August.

“Within the face of a sluggish gross sales tempo – 15.1 million in August – extra sellers are pulling the one lever they’ve: increased incentives,” added Keating. “This shift to a consumers’ market is nice information for customers however definitely impacts seller profitability. Automakers are coming to the desk with extra incentives, however credit score stays tight, placing extra stress on sellers to get inventive with further reductions and financing, affecting the underside line.”

Porsche, Land Rover, Toyota, and Lexus supplied the bottom incentives final month in contrast with different manufacturers.

It’s a Purchaser’s Marketplace for New Automobiles

The brand new-car panorama is a purchaser’s market. Customers heading out to buy a brand new car will discover greater incentives, and certified consumers with stellar credit score will uncover some first rate low-interest-rate affords and lease offers. We’ve additionally seen some dealerships providing further reductions to maneuver 2024 fashions because the inflow of 2025 fashions begins.

A number of carmakers proceed to supply 0% financing offers on car loans. For instance, certified automobile consumers with good credit score can safe a 2024 Subaru Solterra (beginning at $46,340) or a 2024 Mazda CX-30 (beginning at $26,415) for 0% financing for 72 months and 36 months, respectively.

Be sure you store round to search out the most effective deal on the automobile you need to buy.

Small Variety of Autos Nonetheless Promote at Markup Costs

The times of paying greater than the MSRP are largely behind us. Most carmakers and sellers now supply ample stock and supply incentives that decrease automobile costs under MSRP.

Nonetheless, just a few autos stay briefly provide, and dealerships mark up their costs. On Markups.org, which permits customers to report and ship of their photographs of markups seen at dealerships throughout the US, a number of latest dealership market changes have been seen in Lima, Ohio (a 2024 Toyota Sienna AWD with a $3,000 markup), Texas (a 2024 Ford F-150 Raptor R marked up $35,000), and California (a 2024 Toyota Land Cruiser with a markup of $14,995).

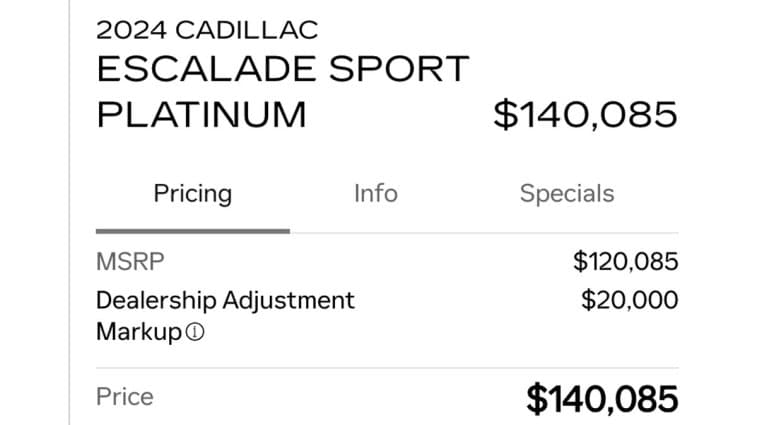

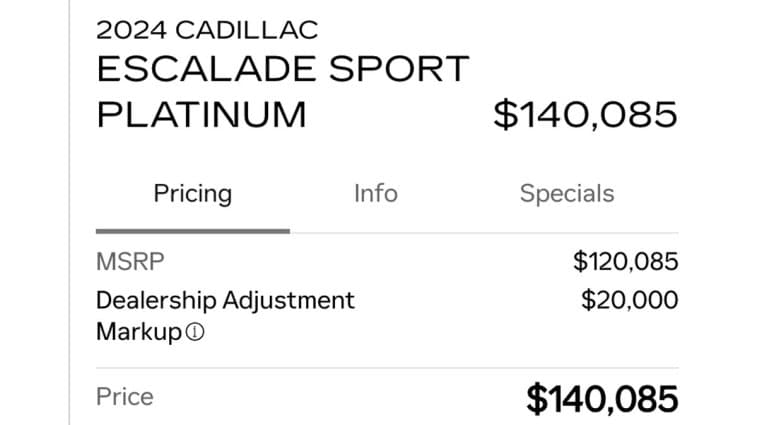

Earlier this summer season, for instance, one Cadillac dealership not too long ago marked up a hard-to-find 2024 Cadillac Escalade Sport Platinum by $20,000 on its web site. Customers should even be vigilant about car charges, seller or market changes, and extras, as seen under at this Florida BMW dealership.

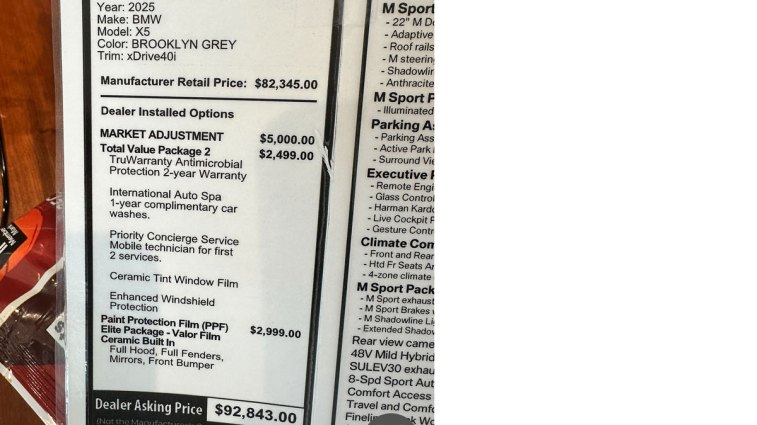

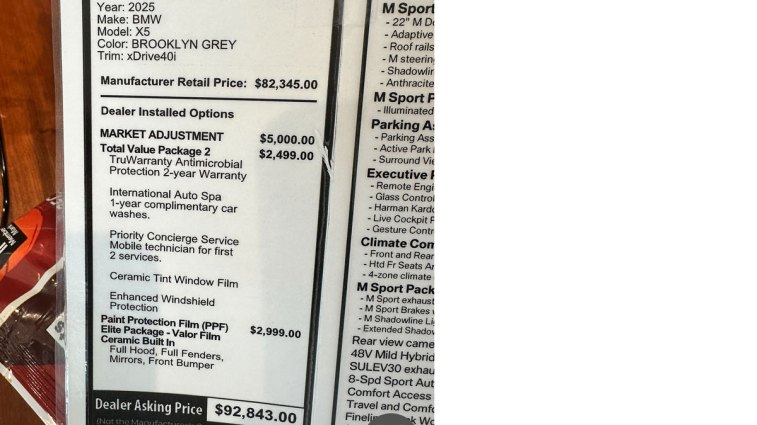

[Editor’s Note: We recently saw a BMW dealership adding a market adjustment of $5,000 for the 2025 BMW X5 in Brooklyn Grey with the xDrive40i trim. The extras on the bill also showed antimicrobial protection, complimentary car washes, priority concierge service, ceramic tint window film, and enhanced window protection for an extra $2,500 and another $3,000 for paint protection film. Before you shop, understand your total and reverse course if you don’t want these expensive extras. Many of these extras are pure markups or profit centers for the dealership. Before you sign anything, it‘’‘s wise to ask the salesperson to remove those fees if they want to sell you the car.]

Learn our article Find out how to Keep away from Supplier Markups in 2024: Purchaser Beware to discover ways to spot and keep away from them.

Store Round for the Greatest Provide on Your Commerce-In

Commerce-in worth is one other issue driving automobile costs. An absence of used car inventory has saved costs increased, giving credence to the concept shopping for a brand new car is cheaper than buying a latest mannequin used one. Because of this, it’s a good time to commerce in your automobile.

Sellers worth your trade-in partly primarily based on what they want in inventory. Subsequently, they’re extra more likely to supply a wonderful deal to consumers on a automobile fewer individuals are searching for at present. In different phrases, a automobile shopper buying and selling a 2018 Honda Civic for one thing else shall be a lot happier with the trade-in appraisal than one with a 2021 Jeep Grand Cherokee.

Automotive consumers ought to put together to buy their trade-in round. It’s barely extra difficult to tug off, however promoting your outdated car to at least one dealership and shopping for your new automobile from a special one could make sense if the ultimate bill numbers work out in your favor. Use the Kelley Blue E book Prompt Money Provide instrument to buy your trade-in car at close by dealerships. If you let the offers come to you, selecting the right trade-in supply to your scenario is simpler. Keep in mind, you possibly can at all times negotiate the supply, and pitting one supply in opposition to the subsequent is just not unparalleled.

The Greater Prices of Automotive Insurance coverage

Based on the Bureau of Labor Statistics, automobile insurance coverage prices have been nonetheless excessive in August at about 16.5% over a 12 months earlier. Bankrate says automobile insurance coverage averages about $2,300 a 12 months for full protection. Earlier than you seal the deal and signal something for a brand new car, examine quotes for automobile insurance coverage.

What to Count on: Trying Forward

The Federal Reserve dropped its finest information all 12 months. The nation’s central financial institution lowered its key rate of interest by half a share level to curb an financial slowdown.

Reduction may deliver not less than somewhat cheer earlier than the top of the 12 months for auto mortgage rates of interest. Fee cuts from the Federal Reserve take time to trickle by way of the financial system.

Cox Automotive Chief Economist Jonathan Smoke stated that even with a charge reduce immediately, “it’s not probably that auto mortgage charges will decline a lot earlier than 12 months’s finish.” The common month-to-month automobile fee has come down. Cox Automotive is the dad or mum firm to Kelley Blue E book.

For customers, automobile funds peaked at $795 in December 2022, in keeping with Cox Automotive information. Final month, the typical American automobile fee fell to $737. Excessive rates of interest made up a few of that expense. The automobile mortgage rates of interest make it onerous for a lot of customers to afford a car if they should finance the acquisition. Based on the latest Cox Automotive analysis, the standard new automobile mortgage rate of interest was a median of 9.58% for brand spanking new autos in August. For these shopping for used autos, charges have been 13.92%.

What to Do If You Want a Automotive Now?

For now, you possibly can both sit again and wait or, when you desperately want a automobile, store round and test for producer offers like money again and low-to-zero rate of interest affords. If you happen to can wait, extra reduction may come if the Fed cuts the speed additional.

Patrons searching for a used automobile ought to weigh prices rigorously if they need to finance proper now. In some circumstances, newer used autos price the identical as new ones. Additionally, you possibly can attempt to negotiate an awesome deal on a left-over 2024 mannequin deal as a result of sellers need to clear their tons earlier than the top of the 12 months.

Editor’s Notice: This text has been up to date for accuracy because it was initially printed. Sean Tucker contributed to this report.