As rates of interest fluctuate and inflation impacts on a regular basis prices, understanding the right way to take out a mortgage is extra crucial than ever.

Whether or not you are searching for funds for training, a house, or a brand new enterprise enterprise, realizing your choices can prevent 1000’s in the long term. Sadly, lending establishments can prey on the susceptible, which is why I’m right here to elucidate the method to you beforehand.

How can I take out a mortgage?

Typically, it is best to start by checking your credit score rating, as a better rating can enhance your eligibility and the phrases supplied. Then, store round and get pre-approved by evaluating choices from numerous lenders, corresponding to banks, credit score unions, and on-line platforms. For those who face issues in getting mortgage approval, it is best to work on enhancing your credit score rating.

Instruments like mortgage origination software program can simplify the applying course of, making it sooner and extra clear. However with a number of kinds of loans out there, from private and auto loans to mortgages and enterprise loans, it is essential to know the way to decide on the best one in your particular wants and circumstances.

This information will equip you with the information to make knowledgeable borrowing selections that align along with your monetary targets.

Which kind of mortgage do you want?

The kind of mortgage you want will immediately affect the paperwork you fill out, your reimbursement plan, and the repercussions of missed funds.

Sorts of loans

- Private mortgage

- Bank card mortgage

- House mortgage

- Small enterprise mortgage

- Auto mortgage

- Pupil mortgage

Let’s go over the kinds of loans from which you’ll be able to select, in addition to the right way to apply for or “take out” every.

The way to get a private mortgage

Private loans are for people who would love assist paying off an merchandise or objects of comparatively low worth—low when in comparison with, say, a house. You would possibly get a private mortgage in the event you want to pay for a pleasant new gadget or, within the case of these residing within the US, repay a hospital invoice.

These wanting to use for a private mortgage ought to first assess their credit score to find out in the event that they qualify. If their credit score rating is low, they might need to take steps to construct it up earlier than they search out a private mortgage.

As soon as you recognize your credit score rating, you possibly can verify a mortgage calculator to pre-determine what you would possibly qualify for. Select a lender and see in the event that they’ll pre-qualify you for a mortgage. This helps you identify which lenders are more likely to say sure earlier than you undergo with your entire mortgage software course of.

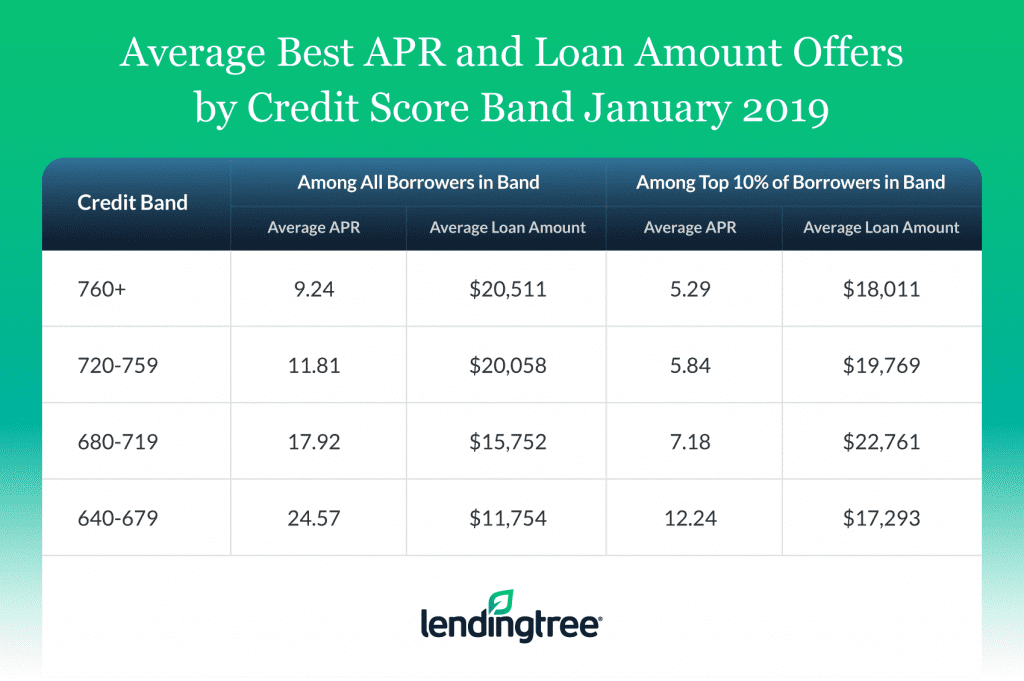

Picture courtesy of LendingTree

When you’ve pre-qualified for a private mortgage with a couple of completely different lenders, examine the affords they’ve given you. You’ll want to analysis the mortgage choices at your native credit score unions and banks as effectively, as their affords is perhaps much more enticing.

Earlier than selecting a lender/mortgage, make certain all the main points are to your liking. Inquiries to ask your self are: does this lender require computerized withdrawals? How versatile are their fee choices? Are there any penalties for paying off a mortgage early?

When you’ve authorized all of the high quality print, it’s time to proceed with the applying course of. You’ll usually have to supply identification, proof of tackle, and proof of revenue. The lender will verify your credit score rating, and it is best to have your funds inside every week after that.

The way to get a bank card mortgage

Bank card loans, that are simply the act of proudly owning a bank card in your title, are for anybody who needs to open a line of credit score. Folks typically do that to enhance their credit score scores, reap the rewards a sure bank card affords, or as a riskier technique to pay for costly purchases they don’t have all the cash for at the moment.

You get a bank card mortgage just by making use of for a bank card and getting authorized. You’ll be able to apply at banks, on-line, over the mail, and at shops that provide their very own bank card, to call a couple of locations.

With the intention to get authorized for a bank card, that you must have a very good credit score rating. This appears counterintuitive since chances are you’ll be making use of for a bank card to be able to enhance your credit score rating. Hopefully, you’ve been capable of construct up credit score in different methods, corresponding to by paying payments and loans on time.

For those who’re rejected, you might have a few choices. You’ll be able to name the cardboard issuer and ask for them to rethink your software. If they are saying no, your different possibility is to attend six months and apply once more after you’ve taken steps to extend your credit score rating.

Methods to enhance your credit score rating

- Assessment your credit score report for errors: Request your credit score report from the foremost credit score bureaus and overview it for inaccuracies. Errors like incorrect balances, late funds that aren’t yours, or outdated info can damage your rating.

- Pay current debt: Your credit score utilization ratio—the proportion of accessible credit score you’re utilizing—makes up a good portion of your credit score rating. Attempt to hold your utilization under 30%.

- Keep away from opening new credit score accounts: Every new credit score software triggers a tough inquiry in your credit score report, which may quickly decrease your rating. Keep away from making use of for brand spanking new strains of credit score within the months main as much as your mortgage software.

- Change into a licensed person: If somebody near you has a very good credit score historical past, ask them so as to add you as a licensed person on one among their bank cards. This may add a optimistic fee historical past to your report and increase your rating.

- Settle delinquent accounts: If you might have any accounts in collections or late, settling them may help enhance your credit score rating. Even in the event you can’t pay the complete quantity, negotiating a settlement or fee plan can cease additional injury to your credit score.

The way to get a house mortgage

House loans are for people who find themselves able to buy a house. This sort of mortgage is often known as a mortgage. Mortgages are long-term loans of nice worth.

With the intention to apply for a house mortgage, you must actually have your geese in a row. place to begin is with a mortgage calculator. It will show you how to take the primary steps to find out the worth vary of properties you possibly can afford.

Amongst different particulars, anybody hoping for a mortgage this massive might want to inform their financial institution of their:

- Credit score rating, credit score report, and credit score accounts

- Out there money for a down fee

- Family revenue

- Out there funds for closing prices

- House value ranges

Very similar to different loans, potential householders can get pre-approved by lenders, which provides them the chance to buy round for the most effective mortgage provide. The usual mortgage is a 30-year mortgage with a hard and fast charge.

Picture courtesy of RefiGuide

When you’ve been pre-approved, you possibly can select the lender you need to use and proceed with the applying course of by means of them.

The factor with mortgages is that many establishments merely received’t lend to you in the event you don’t have a large down fee and cash for the closing prices. It’s practically not possible to buy a house fully by means of borrowed cash.

For those who get denied at first, arrange a financial savings plan and check out once more after getting sufficient cash to pay for at the very least 20 % of the house out of pocket.

The way to get a small enterprise mortgage

Unsurprisingly, small enterprise loans can be found to anybody attempting to start a small enterprise. They’re both awarded by the Small Enterprise Administration (SBA) or an area financial institution.

Banks and lenders solely need to grant loans to folks they know pays them again. Because of this, it’s relatively tough to get a small enterprise mortgage, particularly in the event you or what you are promoting has no historical past of success.

With the intention to get a small enterprise mortgage, you’ll have to make sure you have good credit score. For those who don’t, it is best to spend time working to enhance your credit score. You also needs to analysis native lenders. As a small enterprise, you might have higher luck searching for approval at a smaller, native financial institution.

Earlier than searching for out a small enterprise mortgage, ensure you have written up a marketing strategy. Lenders will need to see this to assist determine in the event you’re price their funding. Additionally it is sensible to make a presentation of your marketing strategy so you possibly can bodily present lenders how well-thought-out your plans are.

When you’re prepared, make an appointment with a mortgage officer to whom you can also make your case. You’ll want to embrace an government abstract along with your marketing strategy to allow them to skim over your work to grasp higher what you need to do.

From right here, it’s actually as much as you to make the most effective argument for what you are promoting and for the mortgage officer to consider in you.

Associated: Be taught extra about UCC filings and the way they have an effect on what you are promoting.

The way to get an auto mortgage

Auto loans are for any individual trying to buy a motorcar.

In most situations, you get an auto mortgage authorized by means of your financial institution or financial institution of alternative. As with all different loans, step one is to verify your credit score rating to ensure you’re as much as snuff.

Following that, it is best to look to get pre-approved for auto loans from on-line lenders. It will assist you determine what a financial institution could be prepared to offer you. After you’ve been pre-approved, decide a month-to-month fee that needs to be lower than ten % of what you are taking residence every month.

Subsequent, it is best to go automobile procuring and examine dealership affords with what the financial institution can provide you.

The way to apply for a scholar mortgage

Pupil loans are reserved for anybody searching for training from an accredited establishment after highschool.

Sometimes, college students apply for scholar loans by means of FAFSA.ed.gov. FAFSA loans college students a sum of cash primarily based on their want.

If the federal authorities doesn’t award you adequate scholar help to make faculty reasonably priced, you possibly can attempt to undergo a non-public lender. Take a look at a number of the greatest non-public scholar mortgage lenders.

You’ll possible want somebody to co-sign on these loans, as anybody coming into into undergrad in all probability doesn’t have numerous credit score constructed up. It’s price saying that scholar loans are an enormous rip-off business, and there are numerous faux mortgage websites on the market desirous to steal your private info.

Because of this, it’s greatest to undergo the federal authorities or a trusted lending establishment.

An alternative choice for getting a secured mortgage

A secured mortgage is another possibility for acquiring a mortgage, because it usually affords decrease rates of interest in change for offering collateral as reimbursement assurance.

Essentially the most generally used possibility is a mortgage with a automobile as collateral. For those who’re a automobile proprietor, you should utilize your car’s title as a pledge and get the wanted quantity to cowl your education-related wants. Simply make certain to decide on a trusted mortgage supplier.

Inquiries to ask earlier than taking out a mortgage

Earlier than making use of for any mortgage, asking the best questions may help you keep away from monetary pitfalls and make knowledgeable selections. Listed below are 5 important inquiries to ask:

1. What’s the whole price of the mortgage?

The full price goes past the mortgage quantity. That you must issue within the Annual Share Price (APR), which incorporates curiosity and any related charges. For instance, a mortgage with a low curiosity charge however excessive charges might price greater than a mortgage with a better charge and no charges.

You’ll want to ask for a breakdown of all prices and examine the APR relatively than simply the rate of interest, because it gives a clearer image of what you’ll pay over the lifetime of the mortgage.

2. Are there any prepayment penalties?

Some loans include prepayment penalties—charges for paying off your mortgage early. Whereas it’d sound unusual, lenders generally impose these penalties as a result of they miss out on curiosity funds whenever you repay a mortgage early.

For those who plan to repay your mortgage forward of schedule, verify whether or not this can set off any further costs. Keep away from loans with prepayment penalties if potential, as these may enhance your whole prices.

3. Can I afford month-to-month funds?

Think about your month-to-month revenue, present bills, and the way a lot room you might have in your price range for added funds. Simply since you qualify for a mortgage doesn’t imply you possibly can comfortably afford the funds.

Assessment the mortgage’s month-to-month reimbursement phrases and guarantee you might have a price range buffer. Ask your self: “If my monetary state of affairs adjustments, will I nonetheless be capable of make these funds?”

4. What occurs if I miss a fee?

Lacking a fee can have severe penalties, together with late charges, rate of interest hikes, or injury to your credit score rating. Understanding the penalties beforehand helps you keep away from surprises.

Ask your lender about their grace interval coverage, how they report missed funds, and whether or not they provide any deferment or forbearance choices for surprising monetary difficulties.

5. Are there higher funding choices?

A mortgage might not at all times be your only option. Think about options like strains of credit score, credit score unions, or purchase now, pay later (BNPL) companies, which can provide higher phrases for particular wants.

Consider all out there choices and ask about flexibility in mortgage phrases, like reimbursement plans or refinancing alternatives. Don’t accept the primary mortgage you’re supplied.

Thanks for lending me your ear

Debt is horrifying, however the reality is, it’s a necessity within the society we’ve invented. You want to have the ability to go locations, however few folks have all of the money for a automobile sitting of their financial savings account.

Be good about any kind of mortgage. Speak to buddies or household about their experiences borrowing cash and see if they’ve any strategies. Don’t take out loans until you must, however keep knowledgeable in the event you do.

Take a look at another methods to safe enterprise funding in your dream challenge.

This text was initially revealed in 2019. It has been up to date with new info.