Low- and middle-income international locations (LMICs) are bearing the brunt of local weather change and want entry to finance to reply and adapt. With their governments wanting funds to spend money on lowering emissions and putting in clear vitality and sustainable infrastructure, they have to complement public spending with finance from the personal sector. However the present international monetary system isn’t providing them the capital they want, at costs they’ll afford.

Moreover, many LMICs are struggling to service their current loans. In 2023, half a dozen international locations defaulted on funds, together with Lebanon and Zambia. Based on the Worldwide Financial Fund (IMF), 68 international locations are liable to defaulting in 2024, together with Ghana, Grenada, the Maldives and different nations significantly weak to local weather impacts.

As these impacts mount, LMICs danger getting right into a vicious circle of debt, simply when they should make investments to turn out to be extra resilient.

Closing this finance hole and boosting international local weather funds are focuses of the upcoming Convention of the Events (COP) local weather assembly in Baku, Azerbaijan, in November. At this ‘finance COP’, because it has been dubbed, world leaders will attempt to agree on the dimensions and sources of funding wanted to help LMICs.

Extending the Sustainable Improvement Objectives to 2050 — a street map

It’s already clear that LMICs will want extra funding than the US$100-billion pot that was agreed at a COP again in 2009. LMICs — excluding China — might want to quadruple their annual investments to $2.4 trillion by 2030 to fulfill their local weather objectives, in line with a 2022 report from an unbiased high-level professional group on local weather finance1. A extra applicable goal — or ‘new collective quantified purpose’, because it’s formally recognized — for elevating local weather finance for LMICs is ready to be agreed in Baku.

One other key query that shall be thought of there’s methods to mobilize extra personal finance. Local weather-related spending by personal households, corporations and monetary establishments doubled between 2019–20 and 2021–22, reaching $625 billion. However 91% of this was home spending concentrated in high-income international locations (HICs)2.

LMICs face obstacles in accessing monetary markets, and so they borrow at increased prices than wealthier international locations owing to precise and perceived financial and political dangers. They typically have decrease credit score scores than HICs. Analysis suggests that is pushed by, amongst different issues, low per capita earnings and financial progress in addition to a rustic’s historical past of defaulting on money owed. Some research additionally counsel3 that the way in which wherein scores are created is biased in opposition to LMICs, leading to a steep enhance in borrowing prices when their scores are downgraded. For these and different causes, in 2022 the Worldwide Vitality Company estimated that an organization in search of to spend money on a big photo voltaic undertaking in Brazil or India would demand returns twice as excessive as they’d if the undertaking had been being inbuilt a HIC4.

Efforts are being made to cut back these funding obstacles, together with reforming the construction and features of the World Financial institution and Worldwide Financial Fund to enhance danger evaluation and make extra low-cost public finance accessible for LMICs. However many of those efforts have but to be absolutely realized.

In the meantime, as consciousness of sustainability and local weather dangers grows, personal traders are more and more in search of to align their portfolios with the purpose of the Paris settlement to restrict international common temperature to 1.5 °C above the pre-industrial common. To help this, sustainable finance requirements, metrics and instruments have proliferated. Nevertheless, these instruments had been initially developed to guard investor property from long-term sustainability dangers. A few of these instruments have destructive unintended penalties for these in search of funding.

For instance, we describe right here how one sustainable finance metric can create perverse incentives that may dissuade traders from supporting LMICs. And we suggest one other strategy to keep away from the dangers of unintended penalties of sustainable-finance measures.

Local weather dangers

Governments borrow cash from each private and non-private lenders. Non-public ‘sovereign-debt traders’ lend governments cash within the type of bonds, payments or notes that have to be repaid with curiosity on the finish of a hard and fast interval — six years on common for LMICs. Loans present governments with capital within the quick time period, above what they accumulate in taxes, to spend on their coverage priorities. However these loans even have compensation prices.

Ideally, governments would use their borrowed cash to stimulate financial progress, permitting them to repay their money owed shortly at low value. In a local weather context, for instance, spending on inexperienced applied sciences may spur progress, or constructing a sea wall may scale back future climate-related losses and damages.

A gasoline flare at an oil-company set up in southern Nigeria.Credit score: George Osodi/Panos Photos

However the prices of servicing money owed can turn out to be disproportionately excessive for LMICs. As of 2023, the governments of those international locations owed traders round $3.9 trillion5. For instance, in 2023, the typical servicing prices of debt as a proportion of presidency income was 14.5% and seven.2% for low- and middle-income international locations, respectively. As LMICs purchase much more debt to deal with local weather impacts, the rising prices will restrict many states’ skills to spend money on resilience.

In the meantime, personal traders, monetary regulators and credit-rating businesses are paying extra consideration to how local weather change may have an effect on loans to international locations6. This consists of analysing how local weather change may have an effect on the economies of borrowing international locations and their capability to fulfill their debt-servicing prices, as effectively the emissions of those nations.

Financiers are more and more setting targets to cut back the emissions impacts of their investments. For instance, monetary establishments representing round 40% of world personal property have dedicated to reaching net-zero financed emissions by 2050.

An array of requirements and frameworks has been created to judge the emissions and climate-risk profiles of sovereign-debt portfolios7,8. Teams creating them embrace the Partnership for Carbon Accounting Financials (PCAF), the Rules for Accountable Funding and the Internet Zero Asset Homeowners Alliance.

Such metrics are effectively which means and precious for evaluating local weather danger. However they should be designed in order to keep away from creating perverse incentives that imply traders exacerbate the local weather finance hole for LMICs, as some do now.

Uneven metrics

For instance how perverse incentives can come up, we’ve checked out one broadly used metric for measuring the extent of emissions related to a sovereign-debt portfolio — the PCAF’s Financed Emissions Normal (the Normal), the most recent model of which was revealed in 2022. On the time of writing, PCAF has greater than 500 monetary establishments as members, collectively managing some $90 trillion in monetary property.

The Normal evaluates the quantity of greenhouse-gas emissions launched to provide $1 of gross home product (GDP) for every nation within the investor’s portfolio — a type of nationwide measure of ‘emissions depth’. It does this by assessing emissions linked to manufacturing within the nation in addition to its GDP, which is adjusted to account for ‘buying energy parity’ (PPP) to help comparisons between international locations on a typical foreign money scale. As an example, think about {that a} ebook prices 75,000 rupiah (round US$5) in Indonesia and $10 in the USA. As a result of it takes twice as many {dollars} to purchase the identical ebook in the USA because it does in Indonesia, a PPP adjustment can be utilized to Indonesia’s absolute GDP to account for the totally different value of dwelling.

Will AI speed up or delay the race to net-zero emissions?

Nevertheless, LMICs are systematically deprived via this emissions-intensity metric, as a result of it focuses on manufacturing and makes use of the identical calculation for all international locations no matter their variations. And LMIC economies usually tend to have each decrease GDPs and a better share of GDP generated from agriculture than are HICs, whose economies are sometimes service-based.

Agriculture — significantly small-scale and subsistence farming — generates comparatively excessive emissions of methane and nitrous oxide, and low contributions to GDP. And it’s laborious to decarbonize. Vitality use — which has tended to account for a excessive share of emissions in HICs — additionally generates excessive emissions, however these might be extra readily decreased via electrification and adopting renewable vitality.

Thus, LMICs fare badly on a metric such because the Normal, as a result of their emissions intensities are comparatively excessive, given their low GDPs. And they’re much less capable of change that utilizing accessible applied sciences, owing to the buildings of their economies. As such, traders pushing for more-sustainable portfolios may choose to not spend money on nations with excessive emissions intensities.

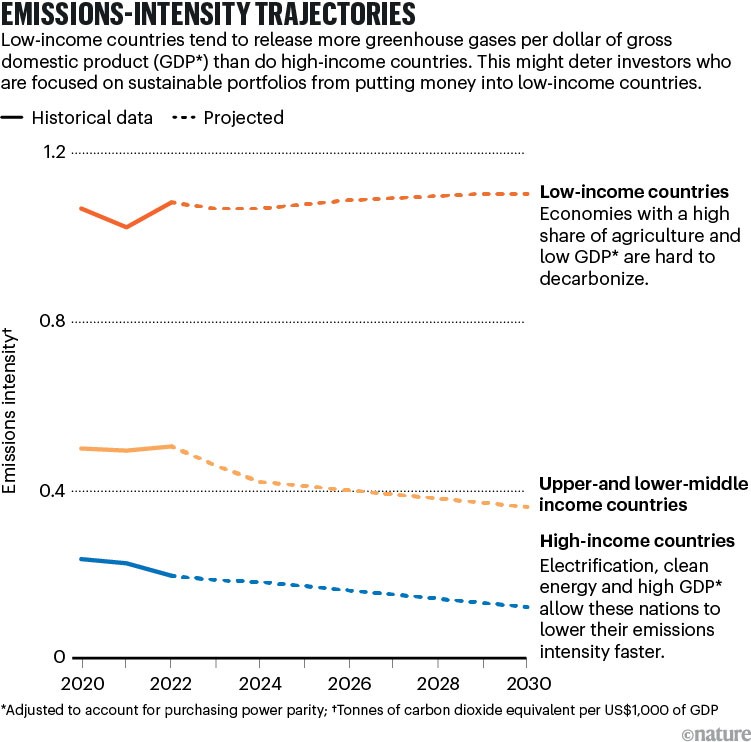

Analysing these (see ‘Emissions-intensity trajectories’), we discover that emissions intensities are a number of occasions increased in most LMICs than in HICs. The 2030 emissions intensities of China and India, for instance, are round 5 occasions that of the UK, and Niger’s is ten occasions that of the UK.

Supply: Supplementary data

Furthermore, variations within the make-up of economies are prone to persist for many years. Analysing the connection between attributed emissions and nation earnings, and projecting it to 2050, we discover that the Normal will proceed to closely favour investments in HICs, even because the GDP of rising economies will increase (see Supplementary data). That is primarily as a result of most HICs have decrease emissions intensities already and targets to succeed in net-zero emissions by or earlier than 2050, whereas LMICs with net-zero targets extra typically have objectives for 2060 or later, balancing the ambition to cut back emission with their improvement wants.

Adjusting GDP for PPP, as is completed within the Normal, mitigates a few of this bias. By specializing in the shopping for energy of a greenback in nation contexts, this adjustment higher displays relative wealth throughout international locations than does absolute GDP. In lots of circumstances, it reduces the emissions depth by greater than half in LMICs. Nevertheless, the usage of GDP adjusted for PPP nonetheless doesn’t offset emissions variations that outcome from variations in financial buildings. Thus, the methodology of the Normal doesn’t degree the taking part in subject completely.

One other danger when making use of such a metric is that it would encourage traders to divest from, or end in increased rates of interest on loans to, international locations that rating poorly — the very nations that want inexperienced funding most.

Portfolio managers frequently use ‘destructive screening’ to keep away from investing in corporations which have poor environmental information or lack net-zero plans. Such an strategy can speed up decarbonization in firms9. The transition to a low-emissions future would require new corporations to emerge and a few high-emitting ones to fail. Nevertheless, sovereign-debt funding is kind of totally different. If traders systematically display screen out international locations, or if score businesses use such requirements in assessing creditworthiness, then LMIC borrowing prices will enhance or their entry to capital shall be decreased10–12. As a result of local weather change is pushed by cumulative international emissions, this may make it more durable for everybody to realize the objectives of the Paris settlement, and it’ll not ameliorate traders’ publicity to local weather danger.

Trade leaders typically suggest that sovereign-debt traders train care in managing their portfolios due to these challenges13. Nevertheless, we expect {that a} totally different strategy is required to handle local weather dangers.

A recent strategy

In our view, sovereign-debt traders ought to transfer away from evaluating nation emissions at a single cut-off date. As an alternative, we suggest that they work with researchers to develop metrics for judging sovereign-debt portfolios which can be primarily based on country-specific emissions pathways, which contemplate nations’ historic emissions efficiency and future trajectories. Such pathways are already broadly utilized by governments and local weather negotiators to judge whether or not nation emissions are in keeping with what’s required to restrict international warming to 1.5 °C 14.

Such a tailor-made strategy would enable traders to construct into their observe the precept of ‘frequent however differentiated tasks and respective capabilities’ acknowledged within the Paris settlement. This precept implies that international locations ought to have totally different emissions-reduction obligations in line with their evolving improvement wants and duty for historic emissions15.

LMICs can be allowed longer to succeed in web zero than would HICs. For instance, a low-income nation may very well be on a improvement pathway that’s in keeping with 1.5 °C of world warming if its targets and emissions reductions are monitoring in the direction of web zero in 2070. However a HIC resembling Australia may want them to trace in the direction of web zero by 2040.

To construct a greater world, cease chasing financial progress

Traders could make funding selections by contemplating an ‘ambition hole’ or the extent to which a rustic deviates from a 1.5 °C pathway. They’ll allocate their capital to help international locations which can be assembly their ‘frequent however differentiated’ Paris targets, relatively than inadvertently penalizing LMICs which can be slower to decarbonize than HICs. This could incentivize nations to do extra.

This strategy additionally has its challenges. Assessments of 1.5 °C-aligned pathways for every nation depend on assumptions about equitable sharing of the remaining emissions finances that the world can use to efficiently restrict warming. Whereas the strategies for creating such pathways are effectively established, no broadly agreed strategy exists for designating nation pathways on this manner, provided that nations have totally different views about what their justifiable share of the worldwide emissions finances is.

Within the absence of such an agreed strategy, transparency relating to assumptions is essential. Additionally it is necessary to judge regularly the incentives that the approaches and metrics adopted create for traders, and the chance that these will help relatively than hinder flows of sustainable finance to LMICs.

Subsequent steps

Sovereign-debt traders and researchers ought to increase their collaborations to develop nation pathways, which may underpin financing selections. Doing so transparently, with the involvement of consultants who develop and assess emissions budgets and pathways for worldwide local weather negotiations, will assist to foster consistency and open dialogue between governments and traders in how they’re assessing their attributed emissions. Unbiased scientists may assess the wide selection of attainable pathways for every nation, every of which is able to suggest totally different trade-offs between fairness and emissions budgets at a world degree16.

Extra broadly, you will need to be aware of the unintended penalties of sustainable-finance metrics for local weather finance flows to LMICs. Philanthropists, traders and researchers ought to type an unbiased group to judge and supply suggestions to keep away from this. An announcement in September by the World Benchmarking Alliance about an initiative to contain traders and a monetary regulator is an efficient first step, however may very well be expanded to incorporate scientists and different outsiders to supply more-independent ‘pleasant challenges’ for traders because the sustainable finance system evolves.

Because the ‘finance COP’ approaches, it has by no means been extra necessary for traders and researchers to make sure that the sustainable finance system doesn’t inadvertently restrict entry to finance to people who want it most.