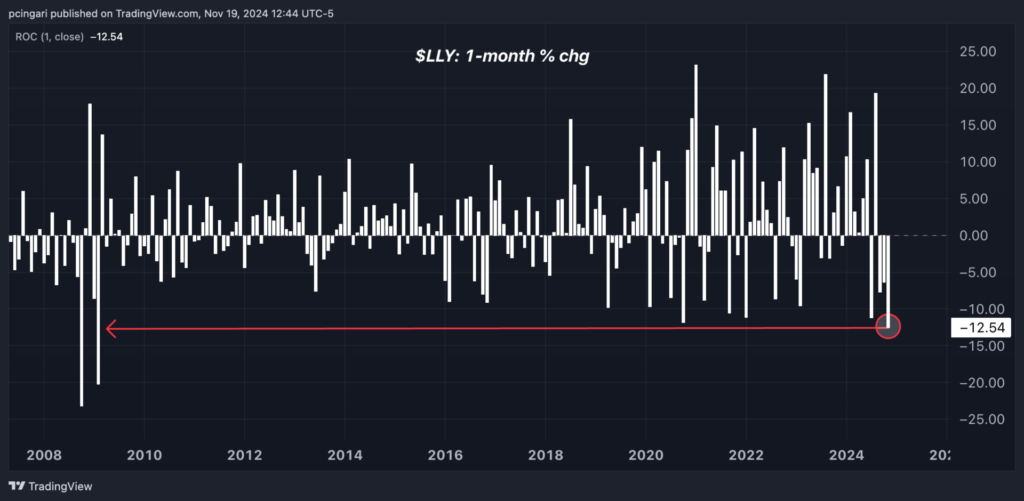

Eli Lilly & Co. LLY shares have nosedived 12.5% month-to-date by means of Nov. 19, placing the inventory on monitor for its worst month-to-month efficiency since February 2009, when it tumbled 20.2%.

The pharmaceutical big, which ranks eleventh by market capitalization within the S&P 500 and holds the highest spot amongst well being care shares, is reeling from a disappointing third-quarter earnings report and lowered steering.

The sell-off raised doubts concerning the near-term prospects for Lilly’s high-profile medicine Mounjaro and Zepbound, which missed income expectations and contributed to a storm of investor uncertainty.

For merchants, the burning query now’s whether or not Eli Lilly’s pullback represents a chance to “purchase the dip” in a high-quality, extremely worthwhile firm that maintains a place of dominance within the well being care market.

Eli Lilly’s third-quarter earnings report, launched on Oct. 30, triggered the inventory’s steep decline in November.

Whereas the corporate has been driving excessive on the success of its diabetes and weight problems medicine, Mounjaro and Zepbound, each underperformed this quarter, lacking income expectations by 14% and 26%, respectively.

Alec W. Stranahan, an analyst at Financial institution of America, stated, “The main target this quarter was once more on Mounjaro and Zepbound, which missed income expectations by a large margin.”

In response to the weak efficiency, Eli Lilly adjusted its full-year income steering.

The corporate lowered the excessive finish of its forecast, projecting $45.4 billion to $46 billion, down from the earlier vary of $45.4 billion to $46.6 billion.

Lilly administration attributed the third-quarter shortfall to non permanent “stock dynamics” moderately than a basic decline in demand, reassuring traders that this was not indicative of a broader drawback with its flagship medicine.

The corporate additionally highlighted its ongoing direct-to-consumer (DTC) promotional efforts, which started within the third quarter and are anticipated to drive gross sales development within the fourth quarter and into 2025.

Regardless of the adverse quarter, Financial institution of America stays bullish on Eli Lilly regardless of the current stumble. Stranahan reaffirmed his “Purchase” ranking on the inventory with a 12-month worth goal of $1,100, implying a 55% upside from present ranges.

As an alternative, Goldman Sachs took a extra cautious stance, sustaining a “Impartial” ranking on Eli Lilly with a 12-month worth goal of $890, implying a 24% upside from present ranges.

Chris Shibutani, M.D., described the third quarter as a “difficult replace” and flagged the $1 billion shortfall in tirzepatide revenues as a major concern.

He expressed skepticism about whether or not the corporate can obtain its revised fourth quarter and 2025 income steering.

The analyst urges warning forward, highlighting that Eli Lilly’s steering assumes vital execution on a number of fronts, from stock administration to worldwide growth. “These elements have to cooperate for LLY to ship,” Shibutani stated.

Double-digit month-to-month selloffs have been a rarity for Eli Lilly, with solely 4 occurrences prior to now 15 years the place the inventory dropped greater than 10% in a single month.

Apparently, previous information reveals Eli Lilly has traditionally rebounded strongly following such declines.

This is how the inventory carried out one month and three months after these main sell-offs:

| Month | LLY Month-to-month Loss (%) | LLY 1-Month Ahead (%) | LLY 3-Month Ahead (%) |

|---|---|---|---|

| October 2020 | -11.9% | +11.6% | +59.5% |

| September 2021 | -10.6% | +10.2% | +19.8% |

| January 2022 | -11.2% | +14.6% | +28.4% |

| July 2024 | -11.2% | +24.1% | +2.3% |

Whereas historical past does not assure future outcomes, the info means that Eli Lilly shares have demonstrated resilience following steep sell-offs, with positive factors starting from 10.2% to 24.1% one month later and a strong common of optimistic returns over three months.

Learn Now:

Photograph: Shutterstock

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.