Again in 2012, British banking large HSBC got here out with a analysis saying that the Philippines may pole-vault to be the sixteenth largest economic system on the earth by 2050.

The COVID-19 pandemic could have set again everybody, nevertheless it hasn’t diminished HSBC’s optimism on this nation.

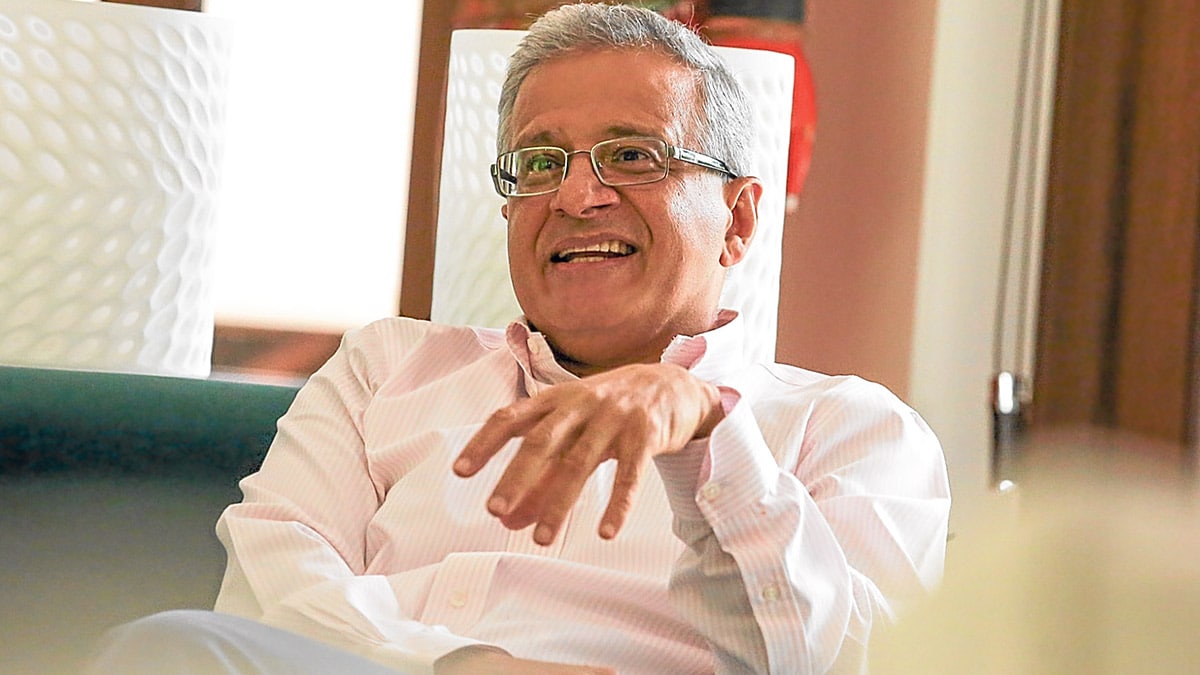

how the nation has fared lately, HSBC Philippines CEO Sandeep Uppal says, “It (financial backdrop) is like seeing a scholar’s report card, the place all the pieces is A+.”

HSBC expects gross home product (GDP) development to choose up tempo to six.7 % by 2026, the quickest in Southeast Asia.

“Credit score development, which has been low, can also be going to begin hitting 9 to 10 % … Then, inflation may also be round 3 % within the subsequent few years, very a lot below management,” he says in a latest chat with the Inquirer.

Article continues after this commercial

In the course of the pandemic lockdowns, many Filipinos saved much less amid the difficult surroundings. However now, they’ve began to rebuild financial savings, seen to rise from 22 % to 25 % of GDP by 2026.

Article continues after this commercial

The identical is true with company Philippines. As soon as the economic system reopened, companies tempered enlargement plans to rebuild money reserves. By the point they have been able to broaden, rates of interest had gone up.

“Now I feel one of many causes that it’s wanting good for the economic system is that corporates are well-stocked. They’re well-positioned to take a position. Rates of interest are coming down, so I feel you’ll see much more investments going to, apart from manufacturing, new malls [and] motels being refurbished.”

Moreover, he says overseas direct funding (FDI) inflows could double within the years forward.

“If there’s no black swan occasion, it appears good for the economic system within the subsequent few years,” he provides.

Uppal believes that the nation has carried out a fairly good job in managing inflation postpandemic—by elevating rates of interest whereas avoiding an financial recession.

After a 9.6-percent GDP contraction in 2020, the economic system grew by 5.7 % in 2021, adopted by a 7.6-percent and 5.5-percent enlargement in 2022 and 2023, respectively.

“So the query for the economic system is, when you’ve been so good along with your development fee with excessive rates of interest, how a lot better will you do it with decrease rates of interest?”

International commodity value shocks, coupled with the native forex depreciation and meals provide constraints brought on by typhoons, animal ailments and different pure disasters, drove shopper costs larger previously two years.

However now that inflation is again to the goal vary of two % to 4 %, the Bangko Sentral ng Pilipinas has began reducing native rates of interest. From 6 % at current, HSBC expects the coverage fee to go down to five % by the top of subsequent yr.

Pharma manufacturing

To herald extra FDIs, Uppal believes one sector to focus on is pharmaceutical manufacturing, provided that the Philippines imports 70 % to 80 % of pharma necessities.

“For those who get extra manufacturing of prescription drugs within the Philippines, it ticks a number of packing containers, plus our demographic [profile] is such that as we age, we’ll eat extra pharmaceutical merchandise,” he says.

“And the advantage of pharmaceutical [industry] is the upper worth added. It offers rise to analysis. It doesn’t use that a lot land, as a result of we now have constraint on land [ownership by foreigners]. Possibly it’s not a lot power-intensive,” he notes.

In July, HSBC helped manage a enterprise mission to India, aiding the Philippine Financial Zone Authority to satisfy buyers. They recognized the 2 most promising sectors—pharma manufacturing and data know-how processing.

Boosting pharma manufacturing will carry down the lofty costs of pharma merchandise and assist native customers, he provides.

BPO development

Enterprise course of outsourcing (BPO) can also be seen to proceed rising. This can be a sector that’s much less capital-intensive however whose worth added is larger, he says.

“In companies, you don’t want a lot FDI. You place in $1 million, the nice half is many of the $1 million could sit within the nation, however the higher half is that the $1 million will generate $10 million of IT-BPO revenues. And that [amount] is all native worth added and stays right here,” he says.

Whereas most nations can export manufactured items, only a few can export companies, he says.

“The Philippines is in place. It’s obtained a stage of scale now with 1.7 million folks [employed in BPOs],” he says.

As multinational establishments put up international companies processing hubs within the nation, he says this won’t solely create extra jobs but additionally enable know-how switch. HSBC is amongst these international establishments which have arrange such a world hub within the Philippines.

Needed: a deeper capital market

One space that wants a bit extra work, Uppal says, is deepening the native capital markets.

At current, he notes that almost all financial savings within the nation are both going to financial institution deposits or invested in actual property, in flip inflating property costs.

Because of the lack of alternatives within the capital markets, he says a number of native fund managers purchase property abroad however hedge within the type of peso-denominated funds that make investments abroad.

He needs for the nation to have extra home securities which can be liquid. Having a sturdy pipeline of preliminary public choices is seen to assist entice extra savers to develop into fairness buyers.

“I feel it’s crucial for the nation to have a really energetic fairness capital market, as a result of you then generate the financial savings into fairness and fairness into productive property like enterprise. We don’t have that. If our savers are then shopping for peso-denominated abroad funds, then the capital goes abroad and never staying within the nation,” he says.

Tourism has potential however…

Uppal additionally agrees that the potential of tourism as an financial driver is big. Consider Japan, a wealthy economic system, from the place 200,000 vacationers go to the Philippines yearly. Nevertheless, Filipinos who go to Japan yearly are thrice greater than that quantity!

For Uppal, flight connectivity is among the key lacking components.

“Our flights are equipped for OFWs (abroad Filipino employees) and never for tourism. The routes the place the OFWs are, we now have superb flight connectivity; Center East is an effective instance; [the United States] is an effective instance,” Uppal says.

“However when you consider it, among the largest markets within the developed world are [the United Kingdom] and Europe, the place we now have few direct flights,” he provides.

Lately, direct connectivity to Europe resumed with Air France providing nonstop flights from Manila to Paris thrice per week. However Uppal says there needs to be extra nonstop flights to extra locations in Europe.

One other instance is India, considered one of Asia’s rising outbound markets for tourism. Thailand and Vietnam are getting an increasing number of vacationers from populous India as a result of they’ve direct flights. Even Cambodia is now beginning direct flights, he factors out.

Assembly his buddies on a visit to India, Uppal gathered how difficult it’s to journey to the Philippines. To get a vacationer visa, Indian vacationers have to go to the embassy to fill out kinds and submit paperwork manually, whereas it’s all digital to use to journey to different nations like Singapore.

He provides that lodge rooms and flights to the Philippines are likewise comparatively costly.

Mobility is vital

“Very often, a multinational company, and even native authorities asks us: The place do you see alternative in Philippines? I give them one phrase, which is each a possibility and a problem—mobility … How do you progress folks? How do you progress items? How do you progress electrical energy? How do you progress water? How do you progress information? A number of the funding [needed] is below the very, very broad class of mobility,” he says.

Going again to the sooner instance, he says India has been constructing eight new airports yearly for the final 10 years, thereby doubling the variety of aviation gateways to 157. It has additionally constructed round 6,000 kilometers of recent highways every year within the final decade.

Hopefully, the identical factor will occur within the Philippines, he says, the place the federal government is trying to make investments round 5 % to six % of GDP in infrastructure every year.

And HSBC will proceed to do its share in serving to the nation—which aspires to graduate into an higher middle-income economic system by 2025—meet its growth goals.

Within the coming yr, HSBC will have fun its a hundred and fiftieth yr of operations within the nation.

“It’s a really proud second for HSBC, however I feel it’s a really proud second for Philippines additionally, {that a} international worldwide financial institution has been on the bottom for 150 years and has prospered over all 150 years and continues to take a position and see nonetheless a brighter future after 150 years,” he says.