For most individuals, shopping for a brand new automotive is a big occasion. It’s traumatic as a result of it includes a considerable amount of cash, and the method can really feel unfamiliar as a result of typical shoppers let years move earlier than purchasing for their subsequent automobile. Even seasoned consumers could discover {the marketplace} is way totally different than after they drove their present automotive off a vendor’s lot.

Just some years in the past, pandemic-related provide chain issues decreased the variety of automobiles on carmakers’ meeting traces. Whereas that drawback eased, automakers realized that solely shoppers with larger earnings and higher credit score scores might simply store for vehicles in an period of inflated costs and rising auto mortgage rates of interest. They made extra high-end automobiles and decreased the manufacturing of cheap fashions.

Increased inventories contribute to decrease new automobile costs in the present day. Information from Kelley Blue Guide’s father or mother, Cox Automotive, exhibits that the typical transaction worth for brand new vehicles in August was $47,870, down 1.7% from August 2023. Incentives for brand new automobiles in August averaged 7.2% of the transaction worth, up 49% from the earlier yr.

Earlier this month, the Federal Reserve minimize rates of interest for the primary time since March 2020. The half-point charge lower implies that borrowing cash will price much less. Whereas it should seemingly take a number of months to see the discount trickle all the way down to auto loans, the speed minimize is nice information for automotive consumers who will finance their new automobile.

You’ve come to the fitting place to discover ways to purchase a brand new automotive. Use our complete checklist of steps to buy a brand new automobile to avoid wasting you time and ease your thoughts through the course of.

10 Steps to Shopping for a New Automobile

When shopping for a brand new automotive, you’ll wish to think about the whole lot out of your procuring model to your funds. Listed here are the steps.

- Know Your Buying Type

- Slender Down your Buying Record

- Calculate a Value You Can Afford

- Do Your Analysis

- Know When the Value is Proper

- Leasing vs. Shopping for

- Discover Financing, Warranties, and Insurance coverage

- Promote or Commerce Your Present Automobile

- Contemplate Your Shopping for Choices

- Get the Most Out of Your Take a look at Drive

1. Know Your Buying Type

Even with a lot automotive data to type via, many individuals nonetheless wish to buy new vehicles inside only some days of deciding to purchase. This implies a consumer might purchase the fallacious automobile for his or her life-style or one with too few or extra options than wanted slightly than making an knowledgeable buy determination.

Bear in mind, as the client, you should be the one in management all through the whole car-buying journey. It’s finest to make some choices alongside the best way earlier than stepping right into a dealership. Even when you have already got a robust choice for the automobile you need, chances are you’ll be pleasantly shocked by the end result for those who take a while to analysis utilizing dependable data and stay open-minded.

Right here’s one solution to begin: Check out the next checklist of various kinds of consumers and resolve which one finest describes you. After that, start your automobile search utilizing one of many handy shortcuts proven beneath, or just comply with all 10 Steps to Shopping for a New Automobile to cowl all of the bases.

Worth Shopper

You need a cheap worth, however you might be keen to pay for high quality.

Brief Minimize: Take a look at Kelley Blue Guide’s automotive values and scroll down to judge 5-year out-of-pocket expense estimates.

Picture Shopper

You get involved with what your automobile says about you. Does it venture a fascinating picture?

Brief Minimize: Go straight to the automobile makes and fashions you like and verify critiques.

Methodical Shopper

You benefit from the chase as a lot because the conquest and canopy each base, turning into considerably of a brand new automotive professional.

Brief Minimize: You’ll must undergo the whole “10 Steps to Shopping for a New Automobile” course of.

Security-Aware Shopper

You need a secure and dependable automobile you’ll be able to belief to maintain you and your loved ones secure on the street.

Brief Minimize: Examine america Division of Transportation’s Nationwide Freeway Visitors Security Administration’s 5-Star Security ranking system.

No matter your procuring model, the knowledge you collect and the hassle you set into the method will serve you nicely and provide help to keep away from the client’s regret that usually accompanies automotive purchases.

2. Slender Down Your Buying Record

Let Your New Automobile Discover You

With tons of of recent makes and fashions obtainable, how do you slim down your checklist? To some extent, your life-style may help.

Think about the actions you’ll expertise in your new automobile. In case you have young children, you want a automotive with one of the best security options and a roomy automobile with ample cargo area for all the products you often carry. Or maybe you care extra about efficiency or model. Or perhaps you’ve a job in gross sales and wish one thing appropriate for taking purchasers to lunch. In case your excellent automobile must haul or tow one thing, you’ll slim your decisions to these.

When contemplating the acquisition of a automotive, the whole lot counts, together with seating capability, variety of doorways, measurement, efficiency, colour, model, consolation, and typically even towing capability. The secret’s to slim your search by creating a brief checklist of decisions earlier than going to the dealership.

The place to start out? Start researching on-line, testing critiques, guides, and Greatest Automobiles lists that may provide help to rapidly slim your checklist of candidates.

Aspect-By-Aspect Comparisons

One other device that may provide help to slim your search is the Aspect-By-Aspect Comparability, which lets you examine specs and see which options are commonplace or elective on every new automotive. That is useful if you end up all the way down to just some automobiles and wish to examine finer factors or options.

Referencing these articles and easy-to-use on-line instruments means that you can analyze your choices earlier than making your last determination. Keep away from making the error of impulse shopping for. A minor delay in automotive gratification is well worth the time spent, particularly when receiving that data from a trusted supply.

3. Calculate a Value You Can Afford

Let Your Finances Do the Driving

When contemplating a brand new automobile buy, the traces of affordability can rapidly grow to be blurred because of the various financing choices obtainable. Clever consumers store for a brand new automobile based mostly on what they’ll afford. Hold an open thoughts, and you might be pleasantly shocked by the checklist of vehicles inside your worth vary.

Affordability is a multifaceted concern as a result of the car-buying course of can contain a number of monetary issues. It can assist for those who precisely decide what your present automotive is price, how a lot of a down cost you may make, and an affordable quantity you’ll be able to deal with for month-to-month funds. Some cautious thought and brutal honesty pays huge advantages later.

Many private finance specialists suggest maintaining your automotive funds prices to not more than 10% of your take-home pay after taxes. Your funds ought to embody month-to-month automotive funds, auto insurance coverage, fuel, upkeep, and repairs. Bear in mind to confer with the 5-Yr Value to Personal tab when critiques for the automobile makes and fashions you like to see estimates for fuel, insurance coverage, repairs, and extra. It could provide help to decide your general funds.

Far too many automotive consumers store for automobiles past their means and like a low down cost. It could lead consumers to drastically misjudge their capabilities concerning month-to-month funds after which wish to scale back the month-to-month funds by stretching out the lengths of the loans, all of which result in bother sooner or later.

One other essential aspect is deciding what to do together with your present automotive. Usually, your automobile could also be price extra while you promote a used automotive your self to a non-public celebration slightly than commerce it in. However many individuals don’t wish to take the time and make an effort to try this. Perceive that for those who commerce it in, you’ll in all probability not get as a lot for it as for those who promote it your self.

The largest concern for many consumers is the worth of the brand new automotive. Happily, figuring out the MSRP (producer’s urged retail worth) is simple, and figuring at the least a spread for a practical transaction worth can be not difficult.

MORE: When Will Automobile Costs Drop?

Calculating Affordability

Discovering your most sticker worth early in your procuring expertise focuses your search and helps keep away from any disappointing surprises later. That is true whether or not you lease or purchase. Right here’s an instance of the sorts of particulars you might encounter while you begin potential vehicles.

- “The automobile I at the moment personal has a trade-in worth of $12,500.”

- “I owe $2,000 on it.” That means you’ve about $10,500 fairness within the automotive.

- “I’ve $2,000 in financial savings I wish to use towards a down cost.” You’ll put down $12,500, together with the commerce.

- “I wish to hold my funds below $500 per thirty days for 60 months.” That month-to-month cost schedule will can help you store for automobiles costing about $39,000, assuming a 5% rate of interest for the $26,500 auto mortgage.

Many on-line instruments may help you establish affordability, together with our automotive affordability calculator.

Your Present Automobile: Commerce It In or Promote It Your self?

In case your automotive is in wonderful situation and you’ve got impeccable service data, it could be nicely price your whereas to promote it by yourself. However, in case your automotive wants a variety of work, chances are you’ll put extra money into it than you’ll be able to get well — so take a practical look earlier than deciding.

Get the Kelley Blue Guide Commerce-in Worth of your present automobile. Based mostly on the situation of your automotive, the worth represents an correct vary of what you’ll be able to count on when buying and selling in your automotive at a dealership. For those who resolve to commerce your automobile, take into account that the vendor should assume the duty for getting ready your trade-in for resale. This course of often contains mechanical and smog inspections and repairs to make the automotive able to promote to the subsequent proprietor. This can price the vendor cash, and the vendor will determine this into the deal.

For those who choose to promote your automobile to a personal celebration, try the Blue Guide Non-public Occasion worth first. That is the worth you’ll be able to count on to get when promoting the automotive to a different client. On this case, you might be solely liable for getting ready your automobile on the market and setting and negotiating a good worth. Learn extra on buying and selling in or promoting your self in Step 8.

Mortgage Quantity

Calculate the month-to-month cost you’ll be able to afford through Autotrader’s automotive cost calculator to find out the quantity you want to borrow. This device components within the rate of interest and the time period of your mortgage. Now add your obtainable money from a down cost and a automotive you commerce with the mortgage quantity (in case you have one), and also you’ll start to reach at a worth that works finest for you.

Additionally, verify for any obtainable buyer or vendor incentives in your new automobile, including to your obtainable money quantity. Bear in mind, you continue to want so as to add taxes, tag prices, and charges, which might differ by state. You may acquire this data via your native DMV.

New Automobile Pricing

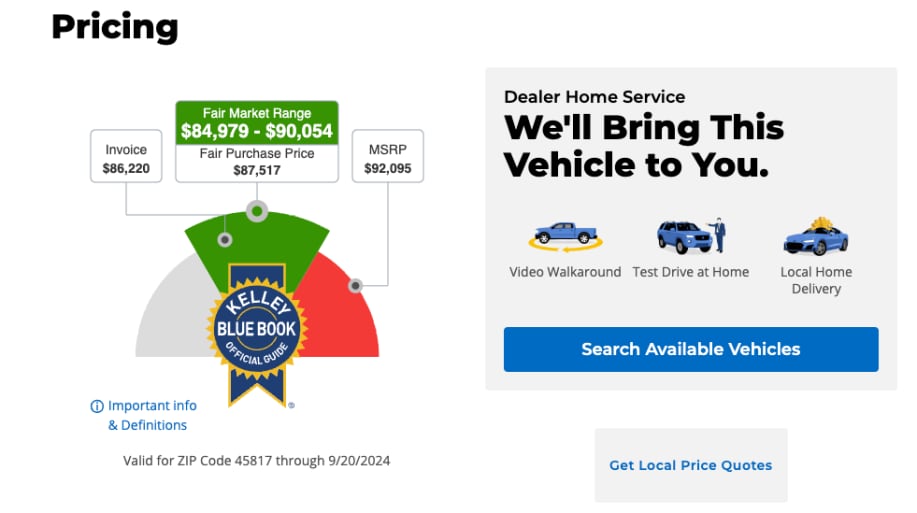

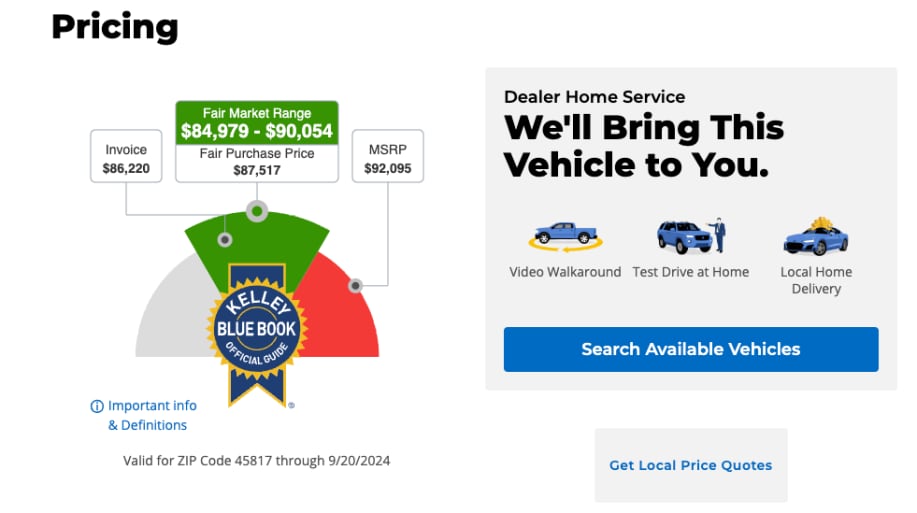

You may decide new automobile pricing on Kelley Blue Guide, which options three kinds of new automotive pricing:

- Bill Value

The bill worth is the vendor’s price for the automobile and its choices. It doesn’t embody what a dealership pays for promoting, promoting, getting ready, displaying, or financing the automobile. See how the bill worth compares to the MSRP on this 2024 Toyota Camry SE. - MSRP Value

The MSRP is the producer’s urged retail worth, often known as the “sticker worth.” By regulation, MSRP should be posted on each new automobile and is often — however not all the time — the very best market worth. Exceptions happen when sure automobiles are in excessive demand or expertise low availability. - Truthful Buy Value Vary

Additionally, try an obtainable worth known as Truthful Buy Value. Up to date weekly, the specialists at Kelley Blue Guide have developed probably the most correct pricing tips for new-car consumers based mostly on buy knowledge collected throughout the nation.

As well as, incentives could also be obtainable for the automotive of your alternative, which is able to deliver down the general worth. Learn extra on new automobile pricing in Step 5.

Your determination to stay to a funds will assist present peace of thoughts, each within the car-buying course of and future. And bear in mind, you’re paying greater than a greenback for each greenback you borrow, so making a considerable down cost towards the acquisition worth makes long-term sense. With these rules in place, it’s best to be capable of start in-depth analysis in your new, shorter checklist of vehicles.

4. Do Your Analysis

What makes a brand new automotive the finest new automobile for you?

With the unbelievable quantity of information obtainable, what particularly do you have to analysis? You’ll seemingly think about pricing and tools choices, and the next:

This data may help you obtain some wanted peace of thoughts. Then, comply with up by researching proprietor opinions and professional critiques.

Security

There are two kinds of vehicle security options: passive and energetic. Know the variations of each and be taught what’s most necessary to you.

Passive Security: This issues itself primarily with the safety of the occupants within the occasion of a crash. For probably the most half, passive security is the job of the automotive, though the occupants have the duty to make use of the seat belts.

These are the options related to passive security:

- Airbags

- Power-absorbing crumple zones

- Aspect-impact beams

- Seat-belt pretensioners

- Head safety units

Lively Security: This issues itself primarily with not having the crash within the first place. For probably the most half, energetic security is the motive force’s job, however sure important options on the automotive may help the motive force keep away from a crash. Options related to energetic security:

The relative significance of those options could differ based mostly upon your driving model and the place you drive. You can too verify the Nationwide Freeway Visitors Security Administration’s (NHTSA) 5-Star Security rankings. These rankings offers you an thought of the relative efficiency ranges of varied vehicles and vans in crashes and the way your potential automobile’s security options examine to others.

RELATED: 12 Greatest Household Automobiles

High quality

A web-based evaluation of how your favourite automobiles charge in high quality could be a true eye-opener. Years in the past, high quality referred solely to the absence of defects in a automotive. Nevertheless, analysis organizations like J.D. Energy and Associates have expanded their analysis evaluation to cowl the optimistic elements of recent vehicles.

This priceless data is offered within the type of the corporate’s high quality and reliability rankings. J.D. Energy is maybe finest identified for buyer satisfaction surveys, together with experiences in dealership gross sales and repair departments.

Skilled Opinions

One other solution to acquire confidence in your buy is to learn what the specialists say about your new automobile. Studying the opinions of specialists earlier than the take a look at drive serves many functions. You may uncover the strengths of the automotive’s efficiency, see how the automotive compares in its class, and learn the way the automobile rides and performs on longer journeys or what it’s prefer to drive round city. Kelley Blue Guide’s group logs tons of of hours driving and evaluating automobiles for its professional critiques of vehicles just like the one you hope to buy.

Proprietor Opinions

Take a look at proprietor opinions. These could be a priceless useful resource on Kelley Blue Guide automobile evaluation pages to find how present drivers charge their new vehicles. After buying your automobile, you’ll be able to submit a evaluation to assist others make knowledgeable choices.

Aspect-By-Aspect Comparisons

Lastly, don’t neglect to run a side-by-side comparability of the automobiles you might be contemplating, and you’re going to get one other stage of perception. Seeing horsepower, mileage, seating capability, headroom, legroom, and different specs side-by-side helps you rapidly establish which automobiles meet your particular wants.

5. Know When the Value is Proper

As soon as you recognize the automotive you need and choose the mannequin, choices, and colour, it’s time to get severe in regards to the worth. One key to success in negotiating for a brand new automobile is accumulating as a lot data as potential earlier than making the deal.

Immediately’s savvy automotive purchaser has the web to thank for serving to to take a few of the thriller out of auto pricing. The net group has offered loads of quick, free, and factual data. Values embody the bill, MSRP, and Truthful Buy pricing.

Bill Value

Realizing the vendor’s bill worth helps you establish the bottom worth a vendor can go and nonetheless make a gross revenue on the sale. Vendor bill is the vendor’s price for the automobile solely and doesn’t embody any of the vendor’s prices for promoting, promoting, getting ready, displaying, or financing the automobile.

It’s an incredible bargaining device when not in a good marketplace for automotive stock. Nevertheless, it doesn’t all the time inform the whole story. Incentives and manufacturer-to-dealer money might scale back the worth beneath the bill in some instances. The common vendor markup over bill price on most high-volume automobiles is lower than 10%. Evaluate this to another trade, and it’s low. Sellers don’t make some huge cash on new vehicles, in order that they negotiate much less on new automotive costs than used vehicles. Sellers make most of their cash on used vehicles, elements, and repair.

MSRP

The MSRP, or producer’s urged retail worth, will get set by the producer and means simply what it implies — a urged worth. By regulation, each automobile bought in America shows this worth.

So who pays the MSRP? It is determined by the automobile and when it’s bought. Within the pandemic period, the dearth of vehicle stock because of the microchip scarcity created a lot better demand than provide. Sellers have been in a position to see automobiles for larger than the asking worth. Immediately, stock is extra sturdy. In consequence, the typical transaction worth is barely lower than the typical MSRP.

The state of affairs is nice for automotive consumers, who’ve better negotiating energy and may take pleasure in discounted pricing and incentives. Nevertheless, you don’t must really feel unhealthy for the dealerships. In contrast to most different enterprise classes, the automotive trade offers retailers the power to supply clients a reduction whereas nonetheless making a revenue.

Truthful Buy Value

The Truthful Buy Value is the trade’s most dependable new automobile pricing device. It will get up to date weekly. The value you obtain on-line particularly displays the worth shoppers are paying for brand new automobiles on a present market foundation. Right down to the particular make and mannequin, these pricing reviews provide a brand new automotive’s typical promoting worth, its typical vary of promoting costs, and the market situations affecting these gross sales.

The Truthful Buy Value isn’t a quantity influenced by sellers or producers — it’s precise transaction knowledge representing a spread of what individuals paid for particular automobiles. This pricing information will profit you tremendously as you resolve what you might be comfy spending to your subsequent automotive.

RELATED: When Will New Automobile Costs Drop?

Elective Gear

The value of your subsequent automotive will rely tremendously on the choices you need. Traits within the trade have moved towards automotive producers placing packages collectively slightly than merely together with choices as separate add-ons.

Having a number of variations of the identical automotive outfitted with extra or totally different options helps streamline automobile pricing. For instance, the favored Subaru Forester compact SUV is available in separate variations, known as trim ranges, together with the bottom Forester, Premium, Sport, Restricted, and Touring. The best trim ranges price probably the most and sometimes are “totally loaded” with “all of the bells and whistles.”

To stay aggressive with the high-volume finest sellers, many producers provide commonplace tools packages such because the Honda Sensing Security suite of driver help applied sciences on all fashions, from automated emergency braking to adaptive cruise management. As the worth will increase, extra options grow to be obtainable on every mannequin sort. For instance, the Honda Civic Touring affords extra security options like its Blind Spot Info System and parking sensors.

Probably the most environment friendly solution to uncover how elective tools will have an effect on the underside line is to “construct” a automotive on-line on the producer’s web site. This helpful device will robotically add the price of every choice obtainable in your automobile and offer you a brand new whole reflecting the extra price components.

MORE: Automobile Security Options 101: All the things You Want To Know

The Market Drives the Deal

You may depend on automotive costs fluctuating as reputation, provide, and different financial components change. In different phrases, if you’re shopping for a well-liked automotive briefly provide, when it first involves market, you’ll be able to count on to pay extra. Costs could drop when rates of interest are low and client confidence is excessive.

Many individuals would by no means dream of paying a premium for something. For the true bargain-hunter, use our useful car-buying ideas that may place you to get the deal you need.

- Out-of-season automobiles, corresponding to a convertible in chilly climate or the winter season.

- Late-model automobiles: within the yr earlier than a body-style change.

- Overstocks or mass-market automobiles include a buyer money incentive that may be larger in the summertime and winter months.

- Deal-making on the final day of the month occurs as a result of sellers have month-to-month gross sales quotas.

- Finish-of-the-year offers at some dealerships might be obtainable as they filter out stock for tax causes.

The analysis you’ve finished to this point offers you a consolation stage on the fitting worth of your subsequent automobile. A educated and respected vendor will be capable of negotiate a good cope with you and take a look at its finest to transform you right into a loyal return buyer. Immediately, all you want while you get to the dealership is key data to confidently transact your new automotive buy. Learn extra on discovering a vendor in Step 9.

6. Leasing vs. Shopping for

Common transaction costs for brand new vehicles are nonetheless excessive, however they’ve been on a downward monitor from the record-high costs in December 2022. Extra just lately, the larger thorn in automotive consumers’ sides is excessive rates of interest for auto loans. Nevertheless, some reduction is anticipated within the coming months because of the Fed’s charge minimize earlier this month. Throughout that point of excessive costs and excessive rates of interest, some artistic financing emerged, tempting some consumers with guarantees of longer mortgage phrases to assist decrease mortgage funds. Now, with stock rising and a few financial stress easing, sellers and automakers are providing extra incentives and financing specials to draw clients who will buy or lease a brand new automotive.

Nevertheless, in all finance eventualities, some type of payment is hooked up. The query then turns into, which monetary method finest meets your wants?

Leasing

Decrease month-to-month funds and little to no cash down could make automotive leasing seem to be an incredible deal. The reality is that leasing affords comfort, however solely if you’re keen to place up with restrictions.

Lease agreements sometimes prohibit mileage to 10,000-12,000 miles per yr, require diligent maintenance and care of the automobile, and, in some instances, impose penalties for early termination.

When a lease deal is obtainable to you, pay shut consideration to the negotiated buy worth of the automobile. Additionally, search for any charges outdoors the lease charge, and by no means signal a lease contract except the residual worth or elective buy worth on the finish of the lease is clearly proven.

You’re a good candidate for leasing for those who choose to have a brand new automotive each few years and put restricted miles in your automotive. One other perk for some is when you’ll be able to write off your automotive lease as a enterprise expense. If you need a lease merely to scale back the quantity of your month-to-month cost, think about that it could be outdoors your sensible functionality to make the funds. Attempt to give severe thought to deciding on a less-expensive automobile, if that’s the case.

RELATED: Automobile Leasing Information: All the things You Have to Know

Shopping for

Earlier than contemplating the acquisition of a brand new automotive, it’s sensible to ascertain the quantity you might be keen to spend or calculate the month-to-month mortgage cost. Don’t neglect that, after negotiating the automotive’s last worth, you will want further money to cowl the tax, title, and registration.

Subsequent up, organize your financing. You could acquire a mortgage with the dealership or producer’s financing. However there are alternatives. You may organize for pre-approval of a mortgage out of your financial institution or credit score union. Whenever you do a few of these issues, chances are you’ll not have a selected automobile in thoughts, only a normal worth vary, and while you make the deal, you write the dealership a verify for the full quantity.

Some establishments offers you a decrease rate of interest for those who select digital mortgage cost, so make sure to ask about it. Learn extra about financing in Step 7.

Bear in mind to verify for incentives in your automobile of alternative. From 0% financing to customer-cash rebates, producers always compete for your online business by making their automobiles and financing extra reasonably priced.

MORE: Can I Purchase a Automobile With Poor Credit score Historical past?

Fast Look Lease vs. Purchase

| STEPS | LEASE | BUY |

| Negotiate Value | Sure | Sure |

| Mileage Limits | Sure | No |

| Down Cost | Usually | Sure |

| Buy Value/Lease Preliminary Worth Taxable* | No | Sure |

| Month-to-month Cost taxable* | Sure | No |

| Increased Insurance coverage Protection Required | Sure | No |

| Can Modify the Automobile | No | Sure |

| Personal at Finish of Time period | No | Sure |

* varies state by state

7. Discover Financing, Warranties, and Insurance coverage

Financing Your Automobile

When there may be buzz about 0% financing offers, you’ll have the urge to hurry to your dealership to use for that terrific interest-free mortgage. Sadly, chances are you’ll discover that, together with roughly two-thirds of all different shoppers, chances are you’ll not have a enough credit standing that may qualify you for the mortgage or the provide. The choice will likely be a special mortgage at a better rate of interest. At that time, the joy of driving off the lot instantly could tempt you to take that larger rate of interest in change for that shiny new automotive. It’s finest to withstand that temptation.

Moreover, a credit standing far below-par signifies an individual who has had issue making funds up to now. That elevated danger to the lender is mirrored within the larger rate of interest to the borrower. Bear in mind, it’s all the time sensible to buy the bottom curiosity automotive mortgage earlier than making the deal. On Kelley Blue Guide, it’s straightforward to buy a mortgage on-line. But when your credit standing isn’t good, it’s not sensible to buy a brand new automotive within the first place.

In case your credit standing appears to be like good, make sure to verify the monetary incentives from the producer. However remember that many interest-free financing affords could require shorter phrases, which is able to end in larger month-to-month funds.

As tempting as a vendor’s low cost financing could appear, don’t overlook different offers. You gained’t face the identical obstacles while you stroll onto the lot with financing in place since you’ve finished your legwork prematurely. And since there’s no obligation till you purchase the automotive, you’ll be able to assess your buying choices in opposition to the vendor’s finest provide.

Go to the finance part to be taught extra about sensible financing.

Can I Purchase a Automobile With Unhealthy Credit score?

Sure, it’s potential. Automobile consumers with poor credit score scores handle to get accepted for automobile purchases frequently. It takes some considerate planning to get the mortgage you need and the automotive you want. Whereas vehicles for bad credit report exist on the “purchase right here, pay right here” sellers, conventional automotive dealerships additionally provide loans with larger rates of interest. That’s the higher choice except you’ll be able to wait it out and take the time wanted to restore your credit score.

Can You Purchase a Automobile With Money?

Sure, you should buy a automotive utilizing you financial savings and never use financing. However, there are execs and cons of paying money to your automobile buy.

Warranties

An prolonged guarantee or service contract will likely be supplied to you when shopping for your subsequent automotive. An prolonged service contract backed by an auto producer is often your most secure guess for those who plan to personal the automotive for a very long time. These contracts embody a variety of repairs and providers. The repairs will be finished at any approved dealership and are typically accepted with out a hitch. You gained’t pay a penny for accepted repairs except your contract features a deductible.

An prolonged guarantee from an impartial firm might price lower than an prolonged service contract from a producer. However the high quality of this type of contract varies extensively from firm to firm. Store fastidiously and solely think about for those who plan to maintain your automobile previous its present warranties.

Insurance coverage Charges

The reality is, vehicle insurance coverage is a necessity. Most states, besides New Hampshire and Virginia, require all automobile homeowners to hold automotive insurance coverage and be capable of present proof of it.

The kind of automobile you select and the historical past of your driving file can profoundly have an effect on the price of insurance coverage. Usually, sports activities vehicles, high-performance vehicles, turbocharged or supercharged automobiles, these with bigger engines, and automobiles with 4-wheel drive typically end in larger insurance coverage charges. Additionally, automobiles with histories of being stolen can demand a premium.

Because it all the time pays to buy round, verify charges together with your insurance coverage firm earlier than shopping for your new automobile.

These extra bills could also be unavoidable and ought to be reviewed fastidiously earlier than making your subsequent automotive buy. In consequence, you might save your self some huge cash and aggravation within the years forward.

RELATED: Estimate Automobile Insurance coverage Prices Earlier than Shopping for

How Lengthy Does it Take to Purchase a Automobile?

It relies upon. Whereas the timing can differ, many dealerships have streamlined the method of shopping for vehicles for the reason that COVID-19 pandemic. However as soon as you recognize what automobile you need, it could take solely two to a few hours to finish the deal. It helps to know your credit standing and get pre-approved for a mortgage for those who finance the automotive. You can additionally resolve to manufacturing facility order the automobile, which doesn’t take a lot time to put, however could require a few months to ship.

8. Promote or Commerce Your Present Automobile

Like most do-it-yourself initiatives, promoting your individual automobile to a personal celebration will be cost-effective. In distinction, buying and selling in your present automobile on the dealership makes it simpler and typically quicker.

Earlier than shopping for your subsequent automobile, think about the professionals and cons of what to do together with your present automobile and make an knowledgeable alternative.

Buying and selling in Your Automobile: The Execs and Cons

Buying and selling in your automotive on the dealership could also be fast and simple, however it could not all the time be painless. The upside of buying and selling is that the vendor does all of the paperwork. After selecting a suitable worth, all it’s important to do is signal the automobile over and be finished with it. The value you pay for the comfort of being relieved of your automobile will seemingly be much less cash for you than for those who bought it your self.

Some individuals count on the vendor to present the total retail worth of the automobile and are sometimes upset by the affords introduced to them. Such persons are being unrealistic. To keep away from any surprises, get the Kelley Blue Guide Commerce-in worth of your automobile, and the Kelley Blue Guide Instantaneous Money Supply choice, which supplies a place to begin for buying and selling in a automobile at a dealership.

This quantity — based mostly on the situation of your automobile — is a extra correct illustration of what chances are you’ll count on to be supplied. Remember the fact that if the vendor goes to re-sell the automotive, it should assume the duty for getting ready it for that eventual resale. This course of often contains mechanical and smog inspections, repairs to make the automotive prepared on the market, and sometimes a guaranty on the automobile for the brand new proprietor. The vendor may additionally promote the automotive to a wholesaler or at an public sale, the place sellers purchase and promote vehicles from and to one another to steadiness their used automobile inventories and make them most acceptable for his or her respective dealerships.

For instance, if you wish to commerce an outdated, worn-out pickup truck at a high-end import luxury-car dealership, the truck will seemingly not go into the dealership’s used automobile stock. In order that truck goes to the public sale.

Buying and selling may also assist for those who owe extra on the mortgage than the automotive is price. This is called being “upside-down.” The vendor can roll the remaining steadiness of your present automobile’s mortgage into the brand new mortgage, thus permitting you to commerce in your automobile with out having to pay more money. Whereas this isn’t advisable — as a result of it inflates the mortgage far past the brand new automobile’s precise worth — it’s an choice for a purchaser who desires to get out of the present automobile. And it’ll price that purchaser some huge cash.

Promoting Your Automobile Your self: The Execs and Cons

Use Kelley Blue Guide’s Non-public Vendor Alternate when promoting your automotive to reinforce the advantages of a personal sale and keep away from a few of the disadvantages.

Promoting your automotive by yourself can get you extra {dollars} however requires endurance and common sense. First, you will want to find out a good asking worth. Kelley Blue Guide Non-public Occasion worth offers you a worth, based mostly on the automobile’s situation, so that you can calculate the worth of your automobile in a consumer-to-consumer transaction.

RELATED: Promote a Automobile: 10 Steps for Success

Bear in mind chances are you’ll want to soak up the price of making the automotive presentable and passing any required state inspections or emissions checks. And bear in mind, first impressions are necessary, so all the time hold the automotive clear and able to be proven whereas it’s obtainable on the market. You additionally must think about what your time is price. You have to to be obtainable to reply questions and make appointments for individuals to see the automobile and take it for take a look at drives.

One other draw back to promoting your automotive your self is that you might be contacted by some unsavory people or individuals you simply don’t really feel comfy with. It’s worthwhile to apply good instincts about individuals and produce robust negotiation abilities. For those who resolve to promote your automotive your self with out utilizing our Non-public Vendor Alternate market, make sure to put the whole lot in writing and request a cashier’s verify or a type of digital cost. Private checks can bounce, and it’s by no means sensible to hold money in giant portions.

RELATED: Greatest Methods To Alternate Funds in a Automobile Sale

Usually talking, factors that may improve the notion of promoting the automotive your self embody:

- Is it a automobile that’s usually in robust demand anyway?

- Is it unmodified, thus interesting to the best variety of consumers who, typically, don’t need another person’s modifications?

- How in regards to the automotive’s situation? What about pricing — does it appear cheap?

Contemplate These Factors When Promoting Your Automobile

- Make your automotive presentable. Give it a wash and wax on the outside and full vacuuming of the inside. For those who actually wish to impress potential consumers, take the automotive to an expert detailer and get the inside, exterior, and engine totally cleaned.

- Find all service data. Carry as full a file of service data and neatly organize the knowledge to your potential purchaser. This can instill confidence that you just took care of the automobile.

- Be trustworthy. Disclose any accidents, severe issues, or repairs to deliver the automobile to right situation.

- Don’t be offended. It’s fairly widespread for potential consumers to get the automotive checked out by an expert mechanic. The most secure solution to deal with this step is to satisfy the potential purchaser on the mechanic’s location. Higher but, do that step earlier than you begin worth negotiations.

- Enable room to barter. Set the asking worth above what you actually wish to depart room for negotiation. And bear in mind, simply since you would possibly assume you “want” a sure amount of cash from the sale isn’t any purpose to count on another person to pay that quantity. A automotive is price solely what somebody pays for it, on that day, at the moment.

Fast Look Commerce vs. Promote

| TRADE | SELL YOURSELF | |

| Cash | You could get much less | You could get extra |

| Pace | Fast | Indefinite |

| Individuals you work together with | Dealership | Indefinite |

| Reconditioning | Dealership | Your duty |

| Paperwork | Dealership | Your duty |

9. Contemplate Your Shopping for Choices

Shifting to the seat behind the wheel of your subsequent new automotive is probably the most thrilling a part of the shopping for expertise. By this time, you narrowed your decisions down to some automobiles which are best for you and set objectives for negotiating worth, month-to-month cost, trade-in, and finance choices. Now you can prepare to barter and buy your subsequent new automobile with confidence.

The normal manner of selecting a vendor has developed. Immediately, there are various choices to approaching the retail automotive buy. You could have an incredible place to start out in case you have a great relationship with a trusted native vendor that gives the model you’re on the lookout for. Handy web instruments are available in many differing types. For instance, Kelley Blue Guide may help you discover the automotive you need, and with an accelerated deal format, join you to finance affords, put you in contact with the dealership with that financing provide, and assist get the automotive delivered to the doorstep.

Utilizing the Vendor’s Web site

Most dealerships through the COVID-19 pandemic up to date the best way to transact with shoppers. It’s potential to purchase a automobile solely on-line and get it delivered to you. After all, you’ll be able to nonetheless go to the dealership to kick tires and signal paperwork in individual.

Visiting a Producer’s Web site

Producers and sellers are adapting to new methods of doing enterprise so shoppers can buy the vehicles they need. Automakers Rivian, Tesla, and Lucid promote their electrical vehicles on to shoppers, with no third celebration concerned.

For different producers, it’s simpler than ever to manufacturing facility order the automotive you need within the colour you need, with all of the options you need, after which choose it up at a dealership. In some instances, they may ship it straight to your door.

Most producers have hyperlinks to their web sites through Kelley Blue Guide’s Free Value Quote device to your comfort. Whereas financial situations make it more difficult to seek out incentives, some producers provide loyalty packages and different particular promotional affords to clients who register straight via their websites. If obtainable, try the newest producer incentives, together with low finance charges, 0% % offers, and buyer money.

Connecting to Direct Shopping for Websites

For those who choose to buy your subsequent automobile from a direct shopping for web site, these on-line firms will work with you to finish the whole transaction with the vendor — all the best way to delivering the automotive to your entrance door.

MORE: How To Purchase a Automobile From Out of State

10. Get the Most Out of Your Take a look at Drive

So that you’ve finished your on-line analysis and positioned a vendor. Now you might be able to expertise the automobile first-hand. When you’re a severe shopper, the vendor will work carefully with you and supply full entry to the automobile for inspection and take a look at driving. For those who plan to check drive a couple of totally different automobiles, let the salesperson know that you’re nonetheless gathering data to make your last determination.

A superb salesperson will know in regards to the automobile’s finer factors and make you conscious of extra options you didn’t discover whereas doing all of your on-line analysis.

Kick the Tires

It’s necessary to stand up shut and private together with your potential new automobile. Ask your self these questions:

- How’s the general look?

- Are there any unpleasant gaps?

- Do the outside and inside colours look good collectively?

- Is the trunk and cargo space spacious sufficient to your wants?

- Is the motive force’s seat comfy and simple to regulate?

- Are the controls straightforward to know and use? Does the steering wheel really feel good in your arms?

Decide what automobile traits matter most to you. If music is your factor, be certain the sound system’s high quality works to your satisfaction. For those who plan to have frequent passengers within the again seat, climb within the again and buckle the seat belt for the total impact. How about comfort options like USB ports, cupholders, or sunglass holders? For those who use them rather a lot, this is a superb time to look at them carefully.

The Take a look at Drive

Now that you just’ve accomplished a radical walk-around, you’ll be able to think about the driving expertise. The take a look at drive may help you make your last determination. Whenever you drive the automobile, take your time. You’ll want to drive on each metropolis streets and the freeway and by no means really feel you want to rush the method.

Whether or not you might be an professional driver or not, there are key areas to remember through the take a look at drive that may in the end matter in the long term.

Trip Consolation

Is the journey easy or uncomfortable? How does the motive force’s seat really feel whereas driving? Are there any uncommon vibrations or jolts while you go over tough roads?

Noise

Do you hear extreme engine, visitors, or different noise coming via the automotive’s cockpit? Are you able to hear the wind coming via the home windows? Or is there annoying street noise from the tires or squeaks and rattles?

Energy and Acceleration

How does the automobile reply while you push the accelerator pedal? Does it hesitate or lurch ahead? Does the engine really feel stable and easy?

Braking

Does the automobile come to a easy cease while you apply the brakes? Do you are feeling any vibrations via the brake pedal? Is the steering affected by the braking? Does the automotive cease in a straight line?

Dealing with

Are you able to park the automobile? Does it appear straightforward to maneuver? Whenever you flip the wheel, does the automotive reply predictably? Is the turning radius tight sufficient to make a U-turn? Are there any blind spots that hinder visibility? Your driving expertise ought to again up the homework you’ve already finished. If not, chances are you’ll wish to revisit your choice.

Now that you just’ve pushed the automotive, chances are you’ll lastly be able to make a stable buy determination. Bear in mind, your last determination will all the time embody a certain quantity of emotion. However the extra homework you full, the much less emotional your precise buy determination will likely be.

Drive Off

A superb deal means various things to totally different individuals. With the assistance of Truthful Buy Costs, you will be assured that you’ll pay the absolute best worth. However bear in mind, worth isn’t the whole lot. Realizing what you wish to accomplish is the opposite half of the battle. Earlier than you shut the deal, ask your self:

- Did I buy a well-built automobile that meets my wants?

- Is it at a worth I can afford?

- Is the worth I paid a great worth for the cash?

- Did I totally perceive and really feel comfy with the whole transaction?

In case you have achieved all these factors, you made a great deal.

After a radical verify of your new automobile and finishing the paperwork, you’ll be able to drive your brand-new automotive, pickup truck, SUV, or minivan residence.

Learn Associated Articles:

Editor’s Notice: This text has been up to date since its preliminary publication.