In April 2025, Australian motorists will lose the power to avoid wasting substantial sums of cash when leasing a plug-in hybrid car (PHEV). It is because the EV Fringe Advantages Tax (FBT) exemption for novated leased autos is ending for PHEVs.

This isn’t a very good consequence for anybody who needs to economize leasing a brand new PHEV and get monetary savings on gas in comparison with a plain petrol or diesel passenger automobile, SUV or ute. It’s additionally not in keeping with the aim of the laws, which was incentivising cleaner automobiles that would emit much less CO2.

Learn on to search out out why the federal government is dropping PHEVs from the novated lease incentive scheme and why that is the unsuitable time to take away PHEV incentives. First although, a quick backgrounder on PHEVs and the novated lease FBT exemption.

What’s a PHEV?

PHEVs are a car with each a combustion engine and a battery and electrical motor(s), however not like common hybrids such because the Toyota RAV4, they’ve a a lot bigger battery that permits them to run for a lot of kilometres on electrical energy alone.

100s of recent automobile offers can be found by CarExpert proper now. Get the specialists in your facet and rating an incredible deal. Browse now.

Some fashions can get near 100km of electric-only vary – that means for many individuals their each day commute will be accomplished solely on electrical energy.

The opposite defining function of a PHEV is that it may be plugged in to a powerpoint or wall charger to recharge the battery.

What’s the FBT exemption?

EVs and PHEVs are exempt from the FBT in the event that they price lower than the Luxurious Automotive Tax (LCT) threshold for fuel-efficient autos, presently sitting at $91,387.

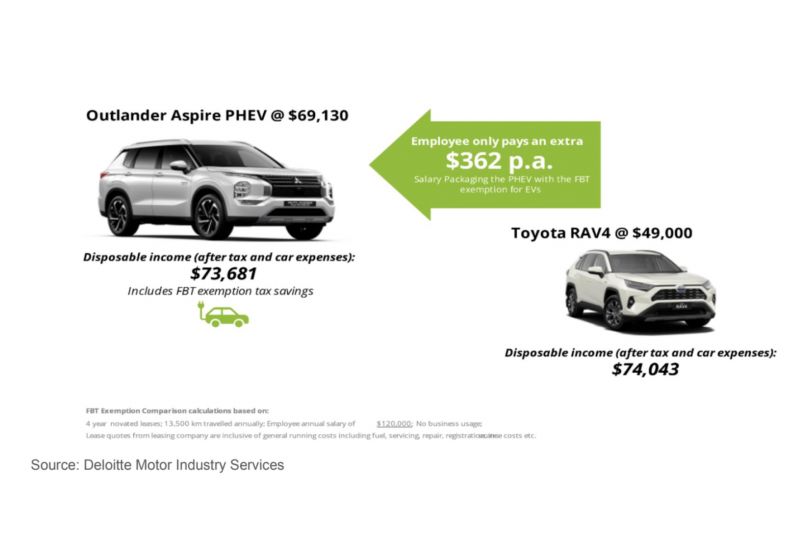

The FBT exemption for EVs on a novated lease means you possibly can drive a significantly dearer EV for a similar price as a less expensive petrol automobile.

To cite from the Nationwide Automotive Leasing and Wage Packaging Affiliation (NALSPA), “Utilizing pre-tax wage deductions, employees can scale back their taxable earnings, keep away from GST on car purchases and working prices, and profit from a secure, predictable cost construction.”

The Australian Monetary Assessment even lists it as a professional tax minimisation apply.

NALSPA CEO Rohan Martin gives a real-world instance with a preferred Tesla:

“Eradicating fringe advantages tax on a $50,000 low or zero-emissions automobile can save an worker round $4,700 yearly,” he mentioned.

“The exemption makes proudly owning and driving a Tesla Mannequin Y, which prices $64,000 drive away, cheaper than a $40,000 petrol-powered Mazda CX-5. Moreover, drivers save additional on working prices by avoiding fluctuating gas costs.”

Word that since we mentioned this with Mr Martin, a Mannequin Y is now even cheaper at between $58,715 and $62,553 drive-away, relying in your state and territory.

Why Is the PHEV FBT exemption going?

In a single phrase – politics. The Authorities didn’t really need this situation to happen. The looming April 1 end-date for PHEVs EV FBT exemption took place as a compromise to get the novated leasing FBT laws by the parliament to grow to be regulation.

With no Liberal/Nationwide votes, the federal government required crossbench assist. The ultimate consequence of the negotiations was PHEV autos could be categorised as EVs from the date the laws commenced on July 1, 2022, however solely till April 1, 2025. After that solely pure electrical autos (aka BEVs) would profit from the FBT exemption.

The top aim was a fast transition to BEVs. The previous argument in opposition to the plug-in hybrid was that some abroad research confirmed many PHEVs owned by corporations didn’t plug in a lot.

This was as a result of the workers driving the autos usually had gas playing cards, which meant they paid nothing for gas anyway. Nevertheless, most must pay out of their very own pocket to cost at dwelling, if charging at dwelling was attainable.

Why PHEVs ought to keep

PHEVs needs to be included within the novated leasing incentives for 3 or 4 extra years but. That is for a few causes, together with that it assists producers to attain their new authorities mandated car effectivity requirements, whereas it additionally assists those that commonly journey into regional Australia, the place charging infrastructure will not be as widespread.

Nevertheless, a very powerful motive is as a result of in Australia there are not any pure electrical car choices for total car segments.

In contrast to North America for instance, there’s no choice of massive pure electrical SUVs and utes but*. That is regardless of the big SUV, 4WD and ute phase producing enormous gross sales right here. The truth is, up to now even in North America electrical autos on this class have been costly, so even when they have been out there right here most wouldn’t qualify for the current FBT exemption anyway.

Australian ute drivers have solely lately been in a position to register expressions of curiosity within the first PHEVs on account of arrive on this phase, the Ford Ranger and BYD Shark.

Given the current state of the market, incentivising PHEVs is the one choice for this type of auto if purchasers are to affordably entry cleaner tech and decrease gas payments. Keep in mind, a high quality plug-in hybrid ute might simply save tradies a few hundred {dollars} a month in gas – and emit much less CO2!

PHEV gross sales at the moment are on the rise, with figures from the Federal Chamber of Automotive Industries (FCAI) revealing a rise of over 120 per cent within the first 9 months of this 12 months, in contrast with the identical interval in 2023.

Given this pattern and now with these massive 4WD PHEVs getting nearer to arrival, it is senseless that cleaner car incentives are going away on the similar time.

Till the appearance of rather more energy-dense and inexpensive batteries can provide massive pure EVs driving ranges corresponding to ICE autos, the one strategy to decrease the emissions of those bigger, heavier autos shall be to purchase these with PHEV expertise.

To cite NALSPA CEO Rohan Martin once more: “Each PHEV bought drives down Australia’s whole transport emissions and that’s vital for our journey to internet zero.”

The journey to internet zero part is necessary, as over right here the previous argument about individuals not plugging in carries much less weight right now.

In Australia, there are merely many extra personal patrons of utes than within the European markets the place the sooner research have been made – and most of those patrons would like to pay much less for costly gas.

Even right now’s commercially owned autos have house owners trying to decrease their fleet prices and meet ESG targets, which novated leasing cleaner autos might help obtain.

If there was a requirement to reimburse drivers for charging bills, even fewer drivers would have issues charging up on this nation.

There must also be fewer issues in accessing residential charging in Australia. This is because of decrease ranges of probably troublesome condo possession (which might deliver charging entry points) than was present in European research.

By taking incentives away from PHEVs subsequent 12 months, the federal government goes to see fewer individuals in a position to afford autos that would lower CO2 emissions and reduce gas payments.

For purchasers of small- to medium-sized SUVs and sedans this can be a lesser drawback as there are many inexpensive BEV choices.

Taking incentives away from entire market segments with no choice of BEVs to select from, nevertheless, is simply going to see extra individuals purchase the cheaper, dirtier autos, which is unquestionably not within the spirit of the unique laws.

*LDV eT60 excepted, however at near $100k and with a 330km vary, unladen, and 1000kg towing capability it’s not a real alternative for phase benchmarks