In response to a survey by the British Boarding Faculties’ Community of its accepted brokers around the globe – which has been solely shared with The PIE Information – the drop would characterize a decline of seven,335 pupils.

It might additionally come at a possible lack of £293 million per 12 months in price earnings, based mostly on common annual boarding charges of £40,000. Such losses might have large penalties for a lot of faculties across the UK.

Suzanne Rowse, director on the British Boarding Faculties’ Community, instructed The PIE: “It is very important do not forget that feelings are presently operating excessive, inflicting brokers and worldwide households to be very involved.

“It is important we don’t assume that there’s a assured pipeline of worldwide college students who will be capable to afford increased boarding charges and that they’ll mitigate in opposition to the probably drop in native pupil numbers,” she added.

It is important we don’t assume that there’s a assured pipeline of worldwide college students who will be capable to afford increased boarding charges

Suzanne Rowse, British Boarding Faculties’ Community

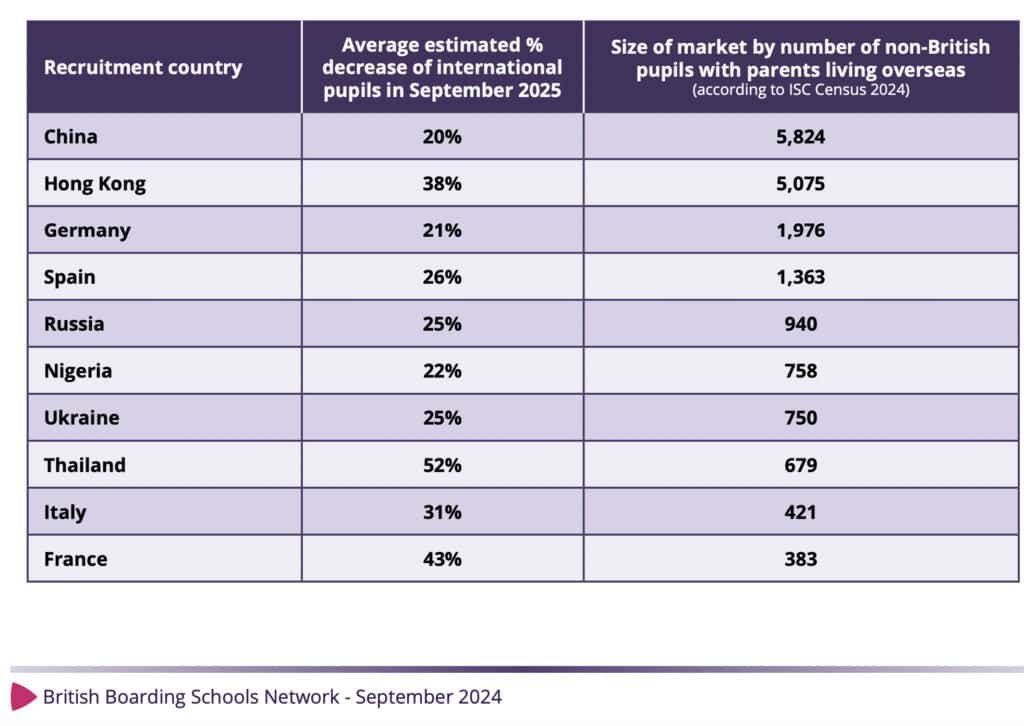

The survey discovered that some worldwide markets will probably be impacted greater than others, with Thailand, France and Hong Kong recording the best estimated decreases in worldwide college students in boarding faculties subsequent September.

Findings from the 180 brokers who accomplished the survey counsel that there might be a 52% lower in worldwide pupils coming from Thailand subsequent September. The survey additionally recommended college students coming from China might drop by 20%, Hong Kong by 38% and France by 43% – all key supply markets for UK boarding faculties.

The survey comes after the brand new UK Labour authorities introduced that impartial faculties must pay 20% VAT subsequent 12 months. From January, the federal government will take away the VAT exemption and enterprise charges reduction for personal faculties, to be able to generate funding for six,500 new academics in state faculties.

The survey discovered that many brokers are involved that households will select various locations for boarding faculties, or worldwide faculties nearer to house, because of the VAT coverage. One nameless agent stated: “Cease this plan or Chinese language college students will go to different international locations to review, and the UK will lose out.”

One other stated: “Dad and mom [are] rethinking their determination for his or her kids to review within the UK. Some will change to Australia and Singapore, with nearer location to China and smaller time distinction.”

Dad and mom rethinking their determination for his or her kids to review within the UK. Some will change to Australia and Singapore, with nearer places to China and smaller time distinction.

Nameless survey respondent

Rowse added that brokers reported that worldwide households’ response to the VAT coverage is shock, anger, frustration, nervousness, concern and distrust of the UK. European households have already been impacted by Brexit, with extra prices for visas.

She stated: “Many college students will probably be unable to afford to remain at their college and end their programs, which will probably be particularly detrimental to these attributable to take exams subsequent summer time.

“This coverage is altering the shopping for behaviours of many worldwide households – they’re now taking a look at examine choices in different international locations quite than the UK, delaying their examine within the UK, or staying of their house nation to attend one of many rising variety of worldwide faculties on provide. This isn’t a time for our sector to be complacent.”

The affect of the VAT on college charges may have “severe destructive affect” on the broader schooling market within the UK, the British Boarding Faculties’ Community harassed, with a possible lack of earnings from the worldwide college students who keep for college after boarding college.

Most brokers who responded (80%) predicted that just about 1,000 boarders presently at a British boarding college is not going to end their course as a direct results of the VAT coverage.

Brokers known as for faculties to be clear about their charges insurance policies and what the precise prices will probably be for subsequent 12 months. One agent stated: “The extra we all know, the higher we are able to help the households. Even for those who can inform us when you should have a plan in place.”

Rowse additionally echoed this: “Our recommendation to our member faculties is to maintain in common communication with their brokers not simply through e-mail but in addition through one-to-one on-line calls and webinars to supply help, keep belief and transparency. While faculties are wrestling with their college charges insurance policies, they should aware of the challenges that our community of valued brokers are additionally going through proper now, particularly those that specialize in UK boarding placements and collectively place 1000’s of worldwide college students into UK faculties.”

In messaging to its members, the community harassed: “Brokers instructed us that they stopped working with faculties who didn’t maintain open communications with them because it eroded their belief.”

The community additionally highlighted that many brokers are involved about their companies as a direct affect of this coverage, particularly those that are centered on pupil recruitment for UK faculties. “Lots of our brokers have devoted years of service to recruiting college students for British boarding faculties and so they worth their partnerships with faculties,” it stated.

“Our survey exhibits that brokers usually are not solely involved concerning the lower in pupil functions for UK faculties, but in addition that fee might lower as nicely, which may have a big affect on their companies.”

The British Boarding Faculties’ Community shared the survey report with The Treasury as a part of the federal government session with suggestions, which closed on 17 September. The findings have additionally been despatched it to its member faculties and brokers.

Rowse stated: “I hope it’s going to inform decision-making while we await the federal government’s ultimate determination on the coverage on 30 October.”

As soon as the federal government finalises the coverage on 30 October, it’s assumed that extra faculties will verify their charges, and brokers and households could make knowledgeable selections. Not all faculties will move on the total 20% VAT – some have already introduced their charges for subsequent 12 months, whereas others have but to take action, Rowse added.

Whereas it’s nonetheless unclear by how a lot faculties will increase their charges, it’s estimated they’ll improve by 8-15%. Sources have recommended that faculties who can afford to will probably attempt to take in among the prices and diversify their income as they suppose extra commercially.

Some faculties will take in the prices of the added 20% tax, whereas others will add the total proportion to their charges.

Eton School has already written to folks informing them that it’s including the total 20% VAT to its college charges from January, taking its annual charges from nearly £53,000 to greater than £63,000.

Established in 2006, the British Boarding Faculties’ Community has been working within the sector for 18 years to attach faculties and recruitment brokers. It has a worldwide community of greater than 350 brokers.